Especially families where the parents only low income are or a mini or midi job, that’s enough income hardly or not at all for a living. Many are therefore applying for a Hartz IV increase so that they can Rent and groceries can pay.

When do you get the child supplement? You can find the answers in our guide.

However, many people in need do not even know that there are others possible benefits there that can be requested. These include, among others housing benefit as well as a children’s allowance, which is paid to the needy in addition to child benefit. The maximum income limit and that are decisive for the child supplement minimum.

Short & flush: the most important thing about the child supplement

- The children’s allowance for low-wage earners Livelihood secure by families with children.

- The family fund pays for each child in need up to 170 euros per month to the parents.

- They are decisive for the child supplement Minimum income limit of 900 euros for parents and couples 600 euros for single parents as well as the parents’ individual maximum income limit.

Who gets it children’s allowance? How much are the payments? Where do I apply for the child supplement? Which requirements must be given? Which documents need for that calculation of child supplement to be submitted to the family fund? You can read more about this in the following guide.

Select your desired topic here:

What is the child supplement?

Child supplement: low-wage earners, for example, have a claim.

The child supplement is one targeted funding low-income families with children. As of January 1, 2005, the child supplement was reduced Section 6a of the Federal Child Benefits Act introduced jointly in accordance with the Fourth Act for Modern Services on the Labor Market (Hartz IV).

The families should above all get ALG 2 including the negative effects such as regular applications for jobs at the job center and possible cuts or Measures at Hartz 4 be spared. In addition, the work incentive for parents to be increased.

The child supplement can be paid per child up to 170 euros per month be. Parents who could secure their own livelihood, but not that of their children, are generally entitled to the child supplement. This is u. a. from one Minimum and a maximum income limit dependent.

As with ALG II, appropriate documents must be submitted for the child supplement to check whether you have one claim on the child supplement paid by the family fund. When calculating Income and property credited. The child supplement can be paid from the month of the application. It only exists as long as child benefit is granted for the children in need. The duration results from the approval notice.

Who is entitled to the child supplement??

In principle, the child supplement for low earners should Ensure family livelihood. Those entitled to child benefit are entitled to their children under the age of 25 if

- the children in common household live and unmarried or are not partnered,

- child benefit or child benefit for the children exclusive performance is related,

- the monthly earnings of the parents reach the minimum income limit,

- the income and assets to be taken into account does not exceed the maximum income limit and

- the needs of the family by paying Child surcharge and possibly housing allowance is covered and for this reason there is no entitlement to unemployment benefit II or social benefits.

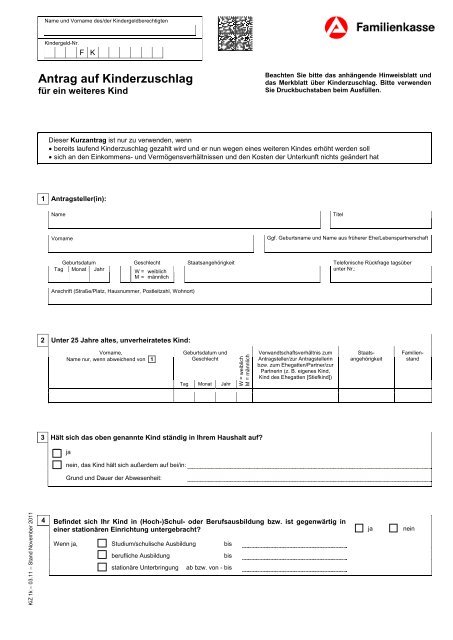

Where can I apply for a child supplement??

If you want to apply for a child supplement, you can do so at responsible family fund to do. This must be done in writing. That for the application from Child supplement required form can be requested from the local family fund or the job center. The application can also be downloaded from the employment agency.

To Expiry of the approval period a new application must be submitted to the family fund. In principle, the child supplement is not paid retrospectively. Therefore, you should fill out the application as soon as possible and submit it with the necessary documents to the family benefits office.

In addition to applying for child supplement following documents be submitted:

- Statement of earnings of the employer

- Declaration on capital

- Declaration on the accommodation costs

You can also download the necessary documents download from the job center or take it with you on site. Depending on the individual case, further documents may be required. You can contact the responsible family fund for this. The staff can tell you which proof You also have to submit so that the Application for child supplement can be edited.

As an applicant or beneficiary of child supplement, you need to change your conditions Immediately inform the family benefits office, as these can affect your performance. Incidentally, this also applies to amendments, that you only become aware of when they become known backdated can affect the entitlement.

You have to communicate following changes In any case:

Certificate of earnings: To apply for the child supplement, all persons in the household must disclose the finances.

- A child first achieves income or wealth or that Financial or income relationships of a child change.

- Your own income or wealth to change yourself.

- The income or asset situation of your partner or in the household living guardians change.

- The Number of household members changes.

- There is a change in the eligibility requirements for benefits for special additional needs (e.g. pregnancy of a household member).

- The need for Accommodation and heating as well as for the ancillary costs changes.

You should see the changes do not communicate in time or completely forget to inform the family fund, the child surcharge must be paid too much, Reimbursed become. You also have to use a criminal prosecution and expect a fine.

Student support and child allowance: Students can apply for help?

Many students have to use one small amount of money get along. In addition to the rent, travel expenses, fees for the Studentenwerk and expensive specialist literature have to be financed. Students also take care of theirs offspring, usually there is not much money left to live.

Next student loans receive child benefit for students with children and can also get one under certain conditions Entitlement to child supplement to have. In principle, however, it can make sense to apply for a child supplement, even if the minimum income is not reached.

It is not uncommon for the employees of the family fund not to know them particularities among students and do not know which deductions the recipients of student loans have so that it becomes a incorrect calculation coming.

Can a child supplement and housing allowance be applied for at the same time??

If you have to struggle through the month as a low-income earner, the money is hardly enough, even with a child supplement for a living out. Therefore, the needy also have the opportunity, housing benefit to apply.

The last increase in the child supplement was in 2016. At that time there was a maximum of 160 euros per child.

So that no ALG II has to be applied for, the combination is from Housing allowance and child supplement common in needy families.

The main advantage is that child supplement and housing allowance not counted as income and therefore do not lead to a reduction in the other service.

Basically, housing benefit is just like the child supplement for a specific approval period granted. Accordingly, new applications must be submitted regularly so that the Services continue to be paid.

By the way: If there is no entitlement to a child supplement, the housing benefit can still be paid requested together with Hartz 4 become. Appropriate applications can be obtained from the job center.

What is the maximum income limit for child supplement??

The maximum income limit is made up of the parental needs according to the regulation on Hartz IV as well as the percentage share of housing costs and the total child supplement. exceeds the income to be considered the income limit becomes the Child allowance not granted.

The standard requirements for the Securing livelihood result from the following table [status: 01.01.2017]:

| authorized | amount in Euro |

|---|---|

| Single parents | 409 |

| of parents | 736 (2 x 368) |

| Children up to 5 years | 237 |

| Children between 6 and 13 years | 291 |

| Children and adolescents between 14 and 18 years | 311 |

| Children of legal age to Completion of the 25th year of life | 327 |

Flat-rate additional requirements come to these amounts for single parents, pregnant women, the handicapped as well as with expensive nutrition for medical reasons or decentralized hot water supply. If necessary, other unavoidable, ongoing special additional needs in hardship cases be invoked.

The needs for Accommodation and heating are based on the actual expenses. The 11th Minimum Living Report of the Federal government. This is as follows:

| Single parents with | Parent’s living quota in% | Parents with | Share of parents’ living in% |

|---|---|---|---|

| 1 child | 77.25 | 1 child | 83,16 |

| 2 children | 62.93 | 2 children | 71.17 |

| 3 children | 53.09 | 3 children | 62,20 |

| 4 children | 45.92 | 4 children | 55.24 |

| 5 children | 40.45 | 5 children | 49.69 |

To do this example: A pair of parents has a child who lives with them in a common household. The monthly rent is 700 euro. Children are entitled to a child supplement if the parents’ gross monthly income Minimum income limit of 900 euros reached.

In addition, the income and assets to be taken into account must not be higher than the sum of the parental needs plus the total child supplement. But how is the calculation necessary for the child supplement? income limit? The following calculation example should provide some clarity:

In order for the parents to receive a child supplement, this must be done gross monthly income amount to at least 900 euros. The income to be considered as well as a any assets must be below the maximum income limit of 1404.19 euros.

How can you calculate the child supplement??

How much is the child supplement??

Not just parents’ income from one marginal employment or another activity with a low gross monthly income is important for calculating the child supplement. Also unmarried children up to the age of 25 can have an income which is used for calculation must be used.

One of the children’s income counts, for example Maintenance allowance from a parent or an orphan’s pension. As capital can an heir e.g. B. can be counted. This property or income is directly from the children’s allowance billed.

Example: A mother and a father with two children receive for both child benefit. Both children have their own income. One child receives maintenance payments of € 100, the other child receives € 200 maintenance. The calculation is as follows children’s allowance:

Child 1: 170 euros (child surcharge) – 100 euros (maintenance) Child allowance of 70 euros

Child 2: 170 euros (child surcharge) – 200 euros (maintenance) 0 euro child supplement

So in this case, the mother would be for a child maximum 70 euros Get child allowance after that income of the children was taken into account. In the second step, the parents’ income is taken into account from the remaining child allowance.

To parents with whom the income taken into account for the calculation single mothers and fathers, spouses who are not permanently separated or registered life partners as well as in one marriage-like community couples living together.

However, other income is fully counted towards the child supplement.

Example: A couple with two underage children live in a common household. The Rent is 750 euros. The father earns gross 1700 euros per month. The mother doesn’t work and takes care of that education of the youngest child.

After the statutory deductions as well as expenses and allowances, the father has an income of 1100 euros. In order to be entitled to a child supplement, the income and assets to be taken into account must be above the minimum income and are below the maximum income limit.

The Maximum income limit is determined as follows:

The father lies with his income of 1100 euros to be taken into account below the maximum income limit. So the family has one Entitlement to child supplement. Because the children do not have their own income, there is a child surcharge of a total of 340 euros for both children.

What you can do if the child supplement has been rejected

Child surcharge: If you are a single parent and the benefit is rejected, you can lodge an objection.

Have you a Application for child supplement and it was rejected, although you are below the maximum income limit, you can Objection to the decision insert and if necessary by a lawyer have it checked.

Often runs at the complicated calculation something goes wrong so that an error occurs. Especially for recipients of student loans or pensioners apply separate regulations, which in individual cases by the Familienkasse need to be checked.

However, if you are below the minimum income limit, you have no claim on child supplement. additionally for child benefit then you have the option, Hartz IV and housing benefit to apply to secure your livelihood.

(62 Reviews, average: 4.10 of 5)

RELATED ITEMS

-

Apply for child supplement: who is entitled?

If their income is insufficient to support the entire family, workers can apply for the child supplement for their offspring. Him…

-

Apply for child benefit retrospectively, hartz 4 – alg 2

Every child in Germany is entitled to child benefit. The legal guardians can benefit from the…

-

Download child supplement application

The exact download club you always wanted to join. The club is now open. Every single man in the world can go to his website…

-

Child benefit 2020: amount, request child benefit, child benefit surcharge

Read all the facts about child benefit 2020, child benefit application, child benefit amount and child benefit surcharge: Who is entitled? When do you pay? What…