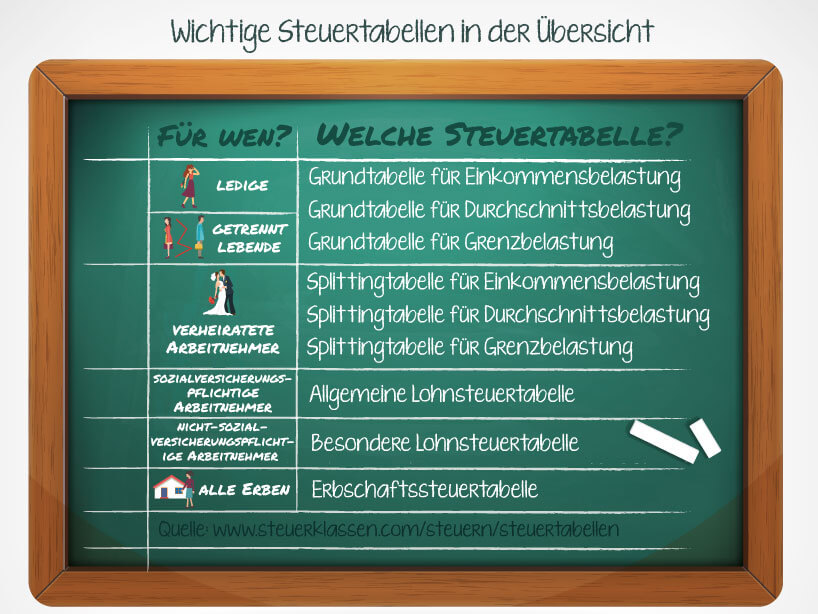

The control tables for income tax have been created to quickly cover the income tax payable to calculate to be able to. Everyone who receives income from non-self-employed work is obliged to pay income tax. Tax tables provide a quick overview of different tax amounts that have to be paid in the tax classes and with different family and employee relationships.

Tax tables – These include:

splitting

The Splitting table for income tax burden is used for married couples. Both incomes are combined and half of them are taken. The amount of income tax is then read from the basic table for income tax and then doubled.

Average load

There is also a basic table for average taxation, which can be found in the data collection on tax policy for 2019. The income tax is a big one part the general tax liability that every citizen has to bear. In order to get an overview of the average burden caused by income tax, the table for the average burden was created.

There is also a splitting table for average couples for married couples, which can be found in the tax policy data collection.

tax bill

The average tax is what the percentage of income tax is. The share is calculated on taxable income.

As with the tax tables for income tax, a distinction is made here between the basic and the splitting table.

The basic table is used for single persons and spouses living separately, the splitting table for spouses.

- With taxable income of up to 5,000 euros in the basic table and 15,000 euros in the splitting table, the average burden is 0. From a taxable income of 80,000 euros in the basic table and 130,000 euros in the splitting table, the values for the average burden continue to increase on. The values are increasingly approaching the so-called limit load.

limit load

In addition to the tax tables for income tax and the average burden, there is also a table for the marginal burden. This specifies which taxes on additional income would have to be paid in addition to the one already specified, i.e. which taxes are due for every additional euro.

The limit load is always above the average load. However, the values converge the higher the taxable income. As with the rest of the data, a distinction is made between a basic table for limit loads and a splitting table for limit loads for married couples.

Falling load over time

It can be seen from the tables for the limit load that it fell sharply between 1958 and 2010. A basic and a splitting table are also available for the limit load.

Priority areas of income tax distribution

Most of the income tax liability is borne by middle-income households. The rich tax has existed since 2007, with which incomes over 270,501 euros are taxed more. Households with low incomes are exempt from paying income tax. This needs to be balanced out by the middle class.

Tax table – all relevant figures and data at a glance

social security contributions

The amount of social security contributions is also relevant for the application of the tax tables, which is why they should be listed here in a table.

| type of tax | employee | employer |

|---|---|---|

| Statutory health insurance | 7.3% + additional contribution | 7.3% |

| church tax | 9% Exception: Baden-Wüttemberg u. Bavaria: 8% |

|

| pension Insurance | 9.3% | 9.3% |

| care insurance | 1.525% Childless people older than 23 pay an additional 0.25%. |

1.525% |

| unemployment insurance | 1.25% Saxony: 2.025% |

1.25% Saxony: 1.025% |

| Shortage pension insurance | 9.3% | 15.4% |

- The solidarity surcharge is also deducted. This is payable in the amount of 5.5% of the wage tax.

Based on this, the income tax tables for 2020 are based on some basic assumptions:

- The contribution ceiling in statutory health insurance and social long-term care insurance is EUR 56,250 ( 2019: EUR 54,450).

- For these, the reduced contribution rate (§ 243 SGB V) is still 14.0%.

- The average additional contribution in statutory health insurance is 0.9%.

- The contribution assessment limit West (BBG West) in the general pension insurance is 82,800 euros ( 2019: 80,400 euros).

- The contribution assessment limit east (BBG Ost) in the general pension insurance is 77,400 euros ( 2019: 73,800 euros).

- The contribution rate to general pension insurance is 18.6%.

- According to §39b paragraph 4 EStG, the partial amount of the pension flat rate for pension insurance is 50% (2016: 64%).

General income tax table 2020

This income tax table applies to all employees subject to social security contributions. Here is the care package within each tax class depending on the level of salary or wages.

| tax bracket | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Basic allowance | 9,408 euros | 9,408 euros | 18,816 euros | 9,408 euros | — | — |

| workers Pauschbetrag | 1,000 euros | 1,000 euros | 1,000 euros | 1,000 euros | 1,000 euros | — |

| Special edition Pauschbetrag | 36 euros | 36 euros | 36 euros | 36 euros | 36 euros | — |

| Relief amount for single parents | — | 1,908 euros | — | — | — | — |

| Wage tax limit for annual wages | 12,972 euros | 15,336 euros | 24,660 euros | 12,972 euros | 1,248 euros | |

| Wage tax limit for monthly wages | 1,081 euros | 1,278 euros | 2,055 euros | 1,081 euros | 104 euros |

Special income tax table

The special income tax table applies to all employees who are not subject to social security contributions, for example civil servants, professional soldiers or judges.

Even when using the special income tax table, the pension flat rate within each tax class depends on the amount of the salary.

| tax bracket | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Basic allowance | 9,408 euros | 9,408 euros | 18,816 euros | 9,408 euros | — | — |

| workers Pauschbetrag | 1,000 euros | 1,000 euros | 1,000 euros | 1,000 euros | 1,000 euros | — |

| Special edition Pauschbetrag | 36 euros | 36 euros | 36 euros | 36 euros | 36 euros | — |

| Relief amount for single parents | — | 1,908 euros | — | — | — | — |

| Wage tax limit for annual wages | 11,018.99 euros | 13,186.99 euros | 20,859.99 euros | 11,018.99 euros | 1,186.99 euros | 9.99 euros |

| Wage tax limit for monthly wages | 918.24 euros | 1,098.91 euros | 1,738.33 euros | 918.24 euros | 98.91 euros | 0.83 euros |

- Since the partial amount for the statutory pension insurance is missing in the special wage tax table for the pension flat rate, wage tax is already levied here when the wages are lower than in the general wage tax table.

Inheritance and gift tax

In our inheritance and gift tax tables, you can see clearly which tax class you belong to and which tax exemptions apply.

In the second table you can see the percentage to which you have to tax certain amounts. The allowances from the first table have already been deducted from the inherited total amount.

RELATED ITEMS

-

Children’s sizes table, all important dimensions at a glance

Are you looking for the right child size for children’s clothing? Here you will find what you are looking for. You can find all of them in our children’s size table…

-

At a glance, Bergheim daycare navigator

Contact Brief info The KITA flea box was created in 1996 and has been looking after children with and without disabilities. Our daycare center offers one in terms of…

-

At a glance, paderborn daycare navigator

Contact Brief info Our family center is located in the Neuhaus castle district in the immediate vicinity of the castle with its extensive castle and floodplain park….

-

16 inch children’s bike – all details at a glance

The following figure shows you 1. Safety features 2. Overall scope of all components and functions Stem with angled cone (1): The stem with…