Credit despite return debit

When it comes to a loan despite return debit, the concerns are usually very large. Borrowing follows its own rules.

Fulfilling all of these is not always easy for the prospect. They go in the direction that the credit rating must be correct in order to put the credit into action.

What is a return debit?

A return debit is carried out by the bank if a payment order is not possible due to lack of cover. This is usually extremely annoying for the person concerned.

Because the return debit clearly shows that at least a temporary insolvency is given. How a loan despite return debit can succeed, what to look for, introduces you to the article.

Starting position – credit despite return debit

If a return debit has been made for lack of cover, financial problems are obvious. The lack of cover is a clear indication that there is an insolvency.

Whether this is temporary or already persists for a longer period of time, is first left undecided. The fact is that there are difficulties in the field of finance.

These difficulties must be eliminated promptly. First and foremost, it is necessary to reorganize and optimize your own income and expenditure.

As a rule, the revenue can not be adjusted quickly, but it usually looks quite different in terms of expenditure. Expenditure can be optimized “from now on”.

And in several areas. Because many fixed costs, which are incurred monthly, are much too high and could be significantly lower.

Anyone who improves on this will quickly realize that a return debit note is no longer necessary. Because a small savings balance can be on every giro account.

Tip:

If you are looking for a loan despite chargeback, then first optimize your income and expenses. Make sure that the potential lender sees that you are making an effort to change your situation.

This is important in order to achieve the best possible creditworthiness.

Credit despite return debit – how to proceed?

With credit despite return debit, it is important to first analyze the situation. There’s no point in sticking your head in the sand and despairing.

Everything is possible in life. Even when it comes to a loan despite return debit.

Adjust the following:

- Account as possible covered

- No negative Schufa available

- Return debit fast paid

- No chargeback on the account statements of the last three months

- Provide collateral for the loan

- Future-proof repayment of the loan in the expenditures

In spite of the return debit note, check whether the credit is serviceable before the loan. Serving means in this context that the installment payment is punctual and secure.

And this month by month. Definitely future-proof planning, that is also thinking of bad times.

If now the expenses are so high that they are above the revenue that will not work. Missing coverage of the account prevents an additional financial expense per month being affordable.

Therefore, an optimization of the outputs must first take place. Only the real budget surplus qualifies for installment payments.

Therefore, credit despite return debit should only apply if you ensure your solvency. Otherwise, the credit does not bring joy, but brings only trouble.

What collateral do you need??

A loan despite return debit must be well secured. Otherwise he does not work and does not bring the desired success.

If the bank statements show that the direct debit was a one-off affair, it is advisable to wait. Banks usually check the statements for a maximum of three months retroactively.

It is more difficult if the return debit is a regular event and the sums are large. In both cases, the over-indebtedness is obvious.

No lender will knowingly engage in the “gambling” of lending to you. The likelihood that he will not see his money again or only with difficulty is huge.

If the latter is the case, then a borrowing is sometimes not recommended. The situation is to be dealt with, so that actually a debt settlement should take place, but no additional borrowing.

If the return debit is a one-time affair, the loan can still succeed despite the return debit with the help of a guarantor. If the Schufa of the prospective customer is still in order, a guarantor can nevertheless be avoidable.

However, without additional support, the borrower pays high risk premiums on the interest rate. With return debit as a recurrent event, no loan, but the debt advice continues to help.

Credit despite return debit – in any amount?

Are financial problems the reason for the loan despite return debit? Then of course not any loan amount should really help.

A relatively large loan causes the rate to drain a substantial part of the household budget. Each loan despite return debit note is therefore always to the personal conditions and circumstances to adapt.

This means that the loan amount should stay as low as possible. In addition, credit generally only makes sense if there is no other way out.

There is no point in over-training. After a few months, you will notice that as a last resort, only the insularity remains.

That does not help anyone. It is also recommended that you take out the loan despite a direct debit with a fixed purpose.

Banks see that the loan is connected with an important project. In addition, a real asset may secure the loan (usual for car loan).

Small loans with fast turnaround time

Particularly small loan amounts, which can amount to 1000 euros, are ideal for a loan despite return debit. With this money, the current account can be at least partially balanced and liquidity produced.

However, such small loans also bring with them some peculiarities. For example, the fact that they are repayable quickly.

They therefore provide only a temporary bridge and no permanent solution. The prospect must therefore be aware from the outset that payday will soon be back.

Only 15, 30 to 60 days of term are usually scheduled for repayment. On top of that, the small liquidity injector costs a relatively large amount of money overall.

It’s the “optional” overheads that literally skyrocket borrowing costs.

Requirements – Credit despite return debit

Every loan requires collateral. With a loan despite return debit this would definitely be the guarantor.

Nevertheless, even the prospective loaner himself must be able to meet some requirements for borrowing. That would be:

- majority

- Permanent residence in Germany

- German bank account

- Stable income at an attractive level

- Possibilities for repayment of the loan

Each loan can only be approved if the prospective client is of legal age. All banks and savings banks agree in this area.

There is also an upper age limit for many banks and savings banks. As a rule, the limit starts at the age of 62 or when you enter retirement age.

There are also some providers that provide a loan to retirees. Especially with online loans, the prospects for credit are still quite good despite the pension.

If you apply for your loan through our portal, we will do that search for you. So you do not end up on comparison portals when making your loan request.

Instead, we will deliver you a suitable offer. Unemployed, Hartz IV recipients, students and housewives can not borrow.

This applies even more to a return debit. Credit for self-employed and freelancers is possible after individual preliminary examination.

Loans despite return debit – what awaits you?

Apply for the loan through our portal, you will immediately receive the instant confirmation or a cancellation. Depending on your credit standing and other conditions for borrowing.

We work together with several German banks. With more than 20 partners, it is even likely that you have several loan offers available.

Our loan commitment also includes the prospective interest rate if you choose the offer. So you see immediately what’s coming.

Data protection is an increasingly important topic today. We attach great importance to data protection according to the latest standard and to correct processing of borrowing.

If you opt for a loan, simply print out the desired loan approval offer. Only sign, enclose and submit the required supporting documents.

Once a complete review and legitimization has been done, the bank pays the money paid out. It is in the account of the borrower after two or three days.

Documents what you have to submit?

No credit without documentation. Since there are digital loans, this question does not answer the same for all providers.

Without the verification of various economic and personal data, no lending takes place. We require personal information such as name, date of birth, address and marital status when applying for a loan.

Economic data is required by each bank in terms of revenue and expenditure. In addition, a query of the Schufa and the legitimacy to verify the identity of the prospective customer.

Income and expenses are shown with the help of the bank statements of the last 4 weeks. In addition, your lender will need the salary statements for the last 1-3 months.

A copy of the identity card or passport (with registration certificate) is also required. Other documents that may be required, the lender asks if necessary.

If a guarantor or a second borrower for your loan despite return debit required, he must also submit the documents.

Our conclusion to the loan despite return debit

A loan despite return debit is not a self-run, but can be put into action. In addition to borrowing, there must always be an optimization of the financial situation.

Otherwise, the loan brings little and only ensures that comes to a tightening of the financial situation.

Related Posts

-

Debt rescheduling despite tips, solutions and suitable banks

Debt restructuring despite Schufa Rescheduling is always a sensitive issue. Because a lot has to be taken into account and as a rule a rescheduling is…

-

Your opinion is in demand: what belongs in a family-friendly mobile home, world-wondrous

Your opinion is in demand: what belongs in a family-friendly mobile home? * Post updated on: 22nd July 2015 What makes a good motorhome for families ?…

-

Express credit with lightning transfer – still money on the account

Express credit with lightning transfer Are you looking for an urgent loan with flash transfer? Hand on the heart , crunchy sayings you will find without…

-

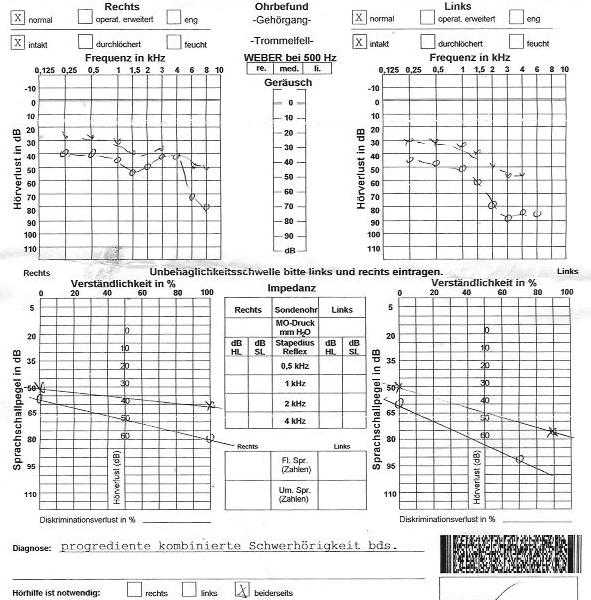

Experience report of a hearing aid beginner Motivation for this review Based on my own experience as a fresh or inexperienced hearing aid wearer, I would…