April 30, 2014 10:19

By Kilian Kimmel

When times became difficult, Commerzbank had to be saved by the state with 18 billion euros. Just over a year ago, the Annual General Meeting approved a substantial capital increase – in order to reduce government participation and to get rid of the unpopular blocking minority of 25% of the bank bailout fund SoFFin.

In order for the bank to be able to issue new shares, ten of the 5.8 billion Commerzbank securities had to be merged into one share. At that time, the CoBa share price was EUR 1.15 or EUR 11.50 per share.

The price is currently fluctuating around EUR 1.30 or EUR 13 per share. The state’s participation currently amounts to 1.6 billion euros (for this share of 1.6 billion euros, the state, that is, all of us, had to pay 5 billion euros, but only occasionally).

A Düsseldorf-based specialist publisher was now dealing with Commerzbank’s sports sponsorship. In this connection, editor-in-chief Axel Prümm asked the Bundesliga club Eintracht Frankfurt why a reputable club is currently entering into a business relationship with the dingy child of the banking industry.

Commerzbank then went to court and demanded injunctive relief and compensation for the phrase “dirty child of the banking industry”. The regional court in Frankfurt commissioned the expression, but found it okay. The detailed justification for the judgment can be found under file number 2-03 O 205/13.

The quarterly figures will come on May 7th, let’s see how the ratio of recent marginal profits to high risks has developed. In any case, I keep my fingers crossed for all CoBa shareholders – let’s hope that Franz-Josef Degenhardt’s winged word from the dirty children does not come true for the shareholders of CoBa …

Inflation lower in euro area than in Japan

You might also like the following

Banks in Germany – look at the great decline

Commerzbank exceeds expectations – what a miracle …

Commerzbank: The dream of a large branch bank is stalled

Leave an answer

shares

January 14, 2020 18:43

The high spirits of investors are currently fueled by trading optimism and the upcoming US quarterly reporting season. But a potential spoiler for the stock markets is already announcing itself.

Round brands are currently magically attracting the stock markets

The current scenario reminds me of my first steps on the trading floor, back then as a securities dealer with a hip new direct broker, where you could trade shares on the Neuer Markt in seconds by fax and phone. Even among my colleagues at the time was that Stock fever broke out and hot tips from the IT, multimedia and biotech sectors were passed around. Back then, the darlings of the investor community were stocks such as EM.TV, Teldafax or Gigabell, some of which, as money-burning machines with sales in the tens of millions, achieved billions of valuations. The mobile phone company Gigabell, one of the most hyped stocks on the market (similar to today Tesla) went bankrupt on September 15, 2000 and many others followed.

Before that, the highflyer price targets were “adjusted” upwards and fantastic, round brands were proclaimed for the “German Nasdaq” named NEMAX. At that time, it almost bordered on blasphemy in the circles of stockholders when one pointed out the gross overvaluation and expressed doubts as to whether the high-tech stock index Nemax All Shares could actually easily cross the 10,000 point mark in 2000.

The German Nemax made it to 8,559.32 points in a final flagpole by March 10, exactly 20 years ago. The sister index called Nemax 50 even made it up to 9,666 points. But then it was over – forever. The market collapsed under the weight of its own valuation and burst illusions. The Nemax started in April 1997 at 500 points. Three years after its high point, on March 21, 2003, the last course for the former hope of many would-be millionaires in Germany was set at 402.91 points.

As in 2000, important stock markets face round brands today. A real déjà-vu overwhelms you when you look at the tech-heavy NASDAQ computer trading center in the USA, where apart from imagination and liquidity, some stocks lack any basis for the valuation. In addition, the most hyped stocks are the heavyweights in stock indices like NASDAQ 100 and S&Form P 500. With 9,070 points on the NASDAQ 100, the round five-digit figure currently seems to be magically pulling the market up. The same phenomenon can be seen in the Dow Jones Industrial Average. Not only in the opinion of US President Donald J. Trump, it is only a matter of time before the round mark of 30,000 is reached (currently 28,925).

Trading deal and reporting season

The bulls, to whom I also count for purely opportunistic reasons, still have some positive impulses on their agenda (Mr. Fugmann also likes to call them carrots), which can at least bring the prices of the mentioned indices closer to the magic round numbers , The eternal carrot in the form of a trade deal is already on the agenda tomorrow. It is now a foregone conclusion that Chinese chief negotiator and deputy prime minister Liu He is coming to Washington with a large delegation to sign the long-awaited deal. But what exactly is in the phase 1 commercial contract is only partially known. However, it is much more important for the markets that there is a first deal at all, because then the Trump administration can immediately hang the next fairy tale in front of the donkey cart: the phase 2 deal.

RELATED ITEMS

-

Don’t play with the grubby kids – frank albers, life and business coach

Podcast (visibility zone): Play in new window | Download (Duration: 17:28 – 16.4MB) The podcast should start deliberately not perfectly, but so…

-

Don’t play with the dirty kids

Already in 1965 the German songwriter Franz Josef Degenhardt brought the desperate search for the song "Don’t play with the dirty children"…

-

Don’t play with the grubby kids – issue 259

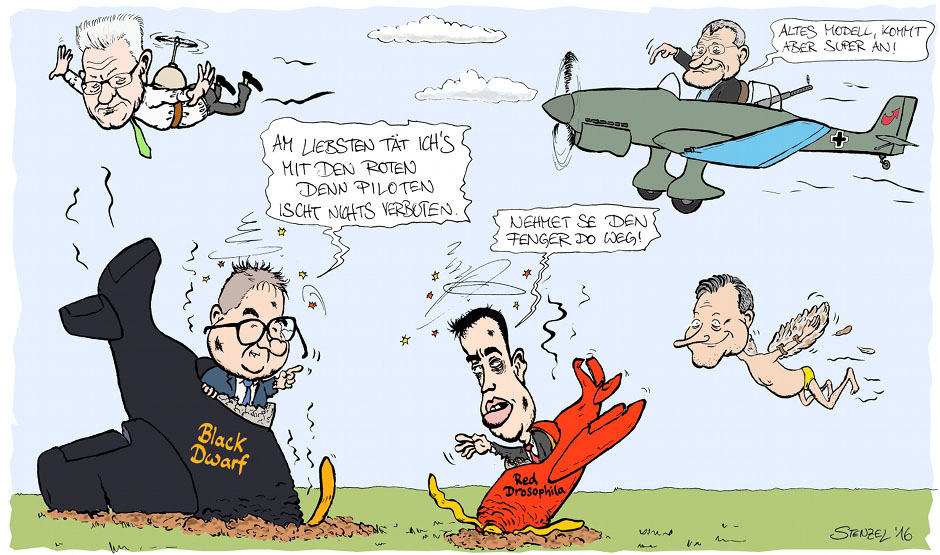

By Johanna Henkel-Waidhofer Landauf, all over the country Winfried Kretschmann is praised as an antidote to the rampant disenchantment with politics. But him and…

-

Playing with the dirty kids (archive)

Outside of Switzerland, Charles Lewinsky became known with his Jewish family saga Melnitz and the play Ein quite ordinary Jew. Earlier…