by Sandra Rosenkranz updated on: 28.01.2018

A separate exemption order must also be issued for a baby or toddler? We use the question and first dedicate ourselves generally to the subject of capital gains tax or flat tax.

Basics of taxing interest income.

All types of income are subject to tax. Every employee is e.g. to income tax. Together with other types of income, income tax is calculated and collected at the end of the year. This principle also applies to interest income on savings accounts. It does not matter whether interest is accrued on a savings account for children, a time deposit account for children or on current accounts when saving for children. This also applies to price gains when investing in shares or funds. Income is subject to Capital gains tax or withholding tax. The interest rate is currently 25% plus sol >

Withholding tax or capital gains tax is also payable on the interest income on a child’s account?

Issue exemption orders, otherwise the tax will be deducted.

The flat-rate regulation takes place via exemption orders. These are to be submitted to the bank and are usually available as an online form. This form must be completed and legitimized using the bank’s security procedure (iTAN, M-TAN …). Every citizen in Germany can get capital gains of up to 801 euros Achieve or exempt from tax.

Of course, the exemption can e.g. not separately for interest income from a time deposit and for interest payments from another investment e.g. Allow daily allowance. The sum all Interest income earned may not exceed 801 euros. So it is not worth splitting and avoiding the capital gains tax. If no exemption orders have been submitted to the bank, the bank pays 25% withholding tax + solidarity surcharge for interest income and 8% or 9% church tax for church membership to the interest income.

Exemption order for children – what should be considered?

Have underage children an own savings account or a call money account are not tax-free. This also applies to price gains from shares and funds realized in the tax year, e.g. a junior depot. Here, too, there is an exemption limit of 801 euros. Capital gains tax / flat tax is payable for interest exceeding this amount. An exemption application must also be submitted here. Again, the sum of all exemption orders must not exceed the limit.

Non-assessment certificate

If the children generate interest income of more than 801 euros per year, however, there are still no taxes below the basic allowance. In order to avoid the annual income tax return, it makes sense to apply for a non-assessment certificate. You can find further information on the non-assessment certificate in our article.

Tax saving model "child" – what is legal?

It is possible to “cleverly distribute” existing capital in the family. However, the decisive factor is the ownership of the account. To one for child own To be able to apply for an exemption, the child must hold the fixed-term deposit or overnight deposit account. Not all banks can do that. The coveted Bank of Scotland investment accounts e.g. may only be opened by adults. However, it is not advisable to redistribute the parental savings system too obviously – a misuse of the legal design, which can also lead to the late payment of the underpaid taxes. Some tax offices make sure that it is really the child’s own money. Of course, gifts to minors are legitimate. It becomes critical if the money from the child’s account is transferred back to the parents.

Money in a child’s account belongs to the child!

Parents should be aware that access to a child’s account is also legally restricted – see our article May Parents Access the Child’s Account?

Find out more about the legal basis of an application and banks that offer a children’s savings account or a junior option. The exemption orders for underage children Under the age of 18 must be submitted by the legal representatives, who also have the power of attorney in the case of a child account and act as the second account holder or authorized representative.

Tax office is informed.

The banks report the income from investments to the tax office and pay the flat-rate tax, including solos and church tax, unless the account holder has exempted them. Because on every exemption order Tax ID an assignment can be made easily at the tax offices.

The most important facts in the summary:

- All income (interest, dividends, bonuses, share price gains) is subject to capital gains tax / flat tax.

- Capital gains of up to 801 euros / person or 1602 euros in the case of a joint assessment can be exempted from tax with one or more exemption orders.

- For children under 18, a separate exemption application must be submitted to account holders (up to € 801)

- Investment income over the allowances or without an existing exemption order will be charged by the tax office with 25% withholding tax plus solos.

Legal advice is not possible due to the regulations of the RBerG. Our contributions and answers only reflect our personal opinion.

RELATED ITEMS

-

Financial investment for children as a tax-saving model

Children are a great asset in the life of parents and as high as the financial burden may be for some families: children are one…

-

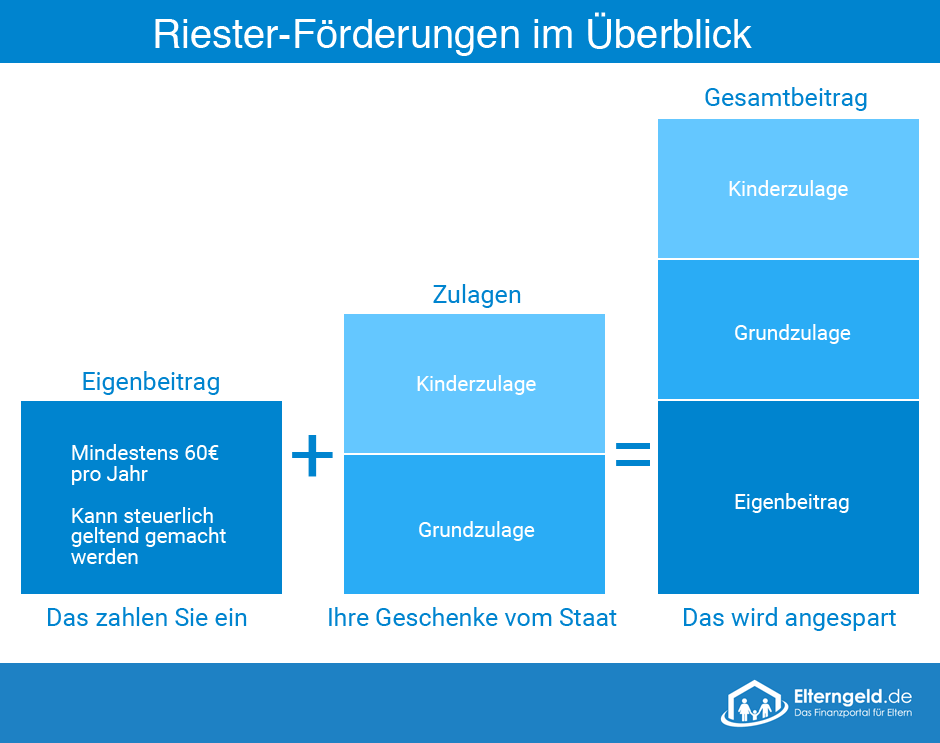

Riester pension: only in 2020 will it really make sense!

Advantages and disadvantages at a glance and whether it really pays off for you…

-

Student job – earnings limit: how much can you earn as a student?

Money is scarce for many students – so they can hardly make ends meet without a student job. Students can do a job over the year…

-

What happens behind the curtains of the companies? Can my boss simply reject the vacation application? What if there are several in one department…