Water is more precious than oil. And unlike this, there is no substitute for it. In fact, it looks like water (or more precisely the hydrogen it contains) could replace oil. As the world’s population continues to grow and living standards rise, many observers expect water to become even more precious. How can you make money with water? What are the prospects? And is it ethical to make money with water? We answer these questions and also ask five promising water stocks and three attractive Funds before.

Top 5 depots for water stocks

Water stocks in a nutshell

- Water conveyors sell drinking water or operate pipes.

- Large parts of the business are owned by the state or local authorities.

- Technical outfitters are often more attractive than development companies.

- Ethical questions must be considered in the self-interest of the investor.

- Funds are a good alternative.

Water share list: you should watch out for these five water shares in 2020

All companies on our water share list generate a relevant share of their sales with the Water as a raw material. We didn’t just choose “classic water companies” that sell drinking water or operate pipeline networks. Companies that supply accessories, for example filter systems, seem even more attractive to us. Because they also earn money where municipal and state companies are responsible for water treatment. They are also less affected by nationalizations or regulations than water network operators.

We selected these five stocks for our analysis:

Xylem: The only "real" listed water company in the world

Whoever prefers to supplier instead of focusing on suppliers, they should Xylem shares observe. The company manufactures devices for the extraction, storage and transportation of drinking water and is the only publicly traded corporation that is exclusively traded on the stock exchange specialized in water is.

The business area includes pumps, agitators and systems for water treatment, but also turbines for generating electricity from hydropower. In 2004, Xylem was also involved in the development of a seawater desalination plant in Dubai, which is expected to use around 45 percent less energy than older plants.

| 2015 | 2016 | 2017 | 2018 (e) | 2019 (e) | |

|---|---|---|---|---|---|

| Turnover in billions of euros (at constant exchange rates) | 3.3 | 3.4 | 4.2 | 4.6 | . |

| Earnings per share in euros | 1.68 | 1.79 | 2.11 | (2.53) | (2.91) |

| Dividend per share in euros | 0.50 | 0.54 | 0.63 | (0.74) | (0.84) |

The most important financial data on Xylem at a glance.

In fact, the share price, sales and profits have developed satisfactorily from the shareholders’ perspective in recent years. According to data in the quarterly report for the fourth quarter, sales at 4.6 billion euros are significantly higher than the previous year’s figure of 4.2 billion euros. Profit and dividends are also increasing steadily. A dividend of EUR 0.84 per share is expected for 2019. The fact that the dividend yield will probably be around 1.3 percent below 2015 is due to the strong price growth. The value of the share has roughly doubled in the past three years.

background: Few investors should know Xylem – unless they are fans of the English football club Manchester City, whose sponsors are Xylem. The lack of awareness is simply due to the fact that the company’s customers are primarily companies.

Xylem’s origins are in the International Telephone and Telegraph Corporation. Under the abbreviation ITT, a conglomerate emerged, which also included many companies in the water sector. After the first division of the conglomerate in 1995 into the areas of industry, hospitality, hotel and finance, the industrial sector was divided again in 2011. Today’s Xylem Inc.

Rating:

Veolia Environnement: General company for water

Veolia is known in Germany primarily as an operator of railways, for example the Bavarian Oberlandbahn or the Nord-Ostsee-Bahn. However, the company largely withdrew from this business in 2018. Instead, Veolia focuses on that Water supply businesses and the disposal or treatment of water.

| 2015 | 2016 | 2017 | 2018 | 2019 (e) | |

|---|---|---|---|---|---|

| Turnover in billion euros | 25.0 | 24.4 | 24.8 | (25.9) | . |

| Earnings per share in euros | 0.69 | 0.57 | 0.61 | (0.64) | . |

| Dividend per share in euros | 0.73 | 0.80 | 0.84 | 0.89 | (0.95) |

The most important financial data on Veolia at a glance.

But above all, is the daughter Veolia Water the world’s largest drinking water company. It offers both services related to the supply and disposal of water. The business with is also promising Sea water desalination plants his.

In the past five years, the share has gained around 53 percent, significantly more than the comparative index. Only in the perspective of three years has the share developed significantly worse than the CAC 40. The reason for this is a decline in sales and earnings in 2016. Since then, the share price, sales and earnings have recovered well, and 2018 will also see an increase in sales and earnings expected. Earnings are expected to grow by around 3.5 percent and will then be EUR 0.64 per share after EUR 0.61 in the previous year. At the same time, Veolia has increased the dividend every year since 2015 and should do so again in 2019.

background: Veolia goes back to the Générale des Eaux, the general company for water, founded in 1853. With the Profits from the water business were taken over from numerous companies in the areas of supply and disposal as well as transport, but also numerous media companies, such as the Havas advertising agency or the pay television channel Canal+.

Because water was only a small part of the business, the company was renamed Vivendi in 1998. In 2002 the area of water, energy, waste and transport, the actual core of the company, was partially sold under the name Vivendi Environnement. The company has had the new name since 2003 and has been completely independent of Vivendi since 2006.

rating:

Acciona Agua: water specialist from Spain

Acciona has one major disadvantage compared to Xylem: The Acciona Agua water division is just one of several pillars. The company is also active in the areas of renewable energies and transport infrastructure. The company even grows wine through a subsidiary.

What makes Acciona attractive in the water business is that Experience with the general conditions in a dry country. Because in many emerging and developing countries, many people are not yet connected to a water network. At the same time, the population is growing, especially in Africa, so that the demand for water is increasing. It is dry in many areas and drinking water must be obtained from sea water, for example. In addition to sewage and water treatment plants, Acciona Agua also offers desalination plants.

| 2015 | 2016 | 2017 | 2018 (e) | 2019 (e) | |

|---|---|---|---|---|---|

| Turnover in billion euros | 6.8 | 6.0 | 7.3 | (7.4) | . |

| Earnings per share in euros | 3.65 | / | 3.85 | (4,5) | (4.8) |

| Dividend per share in euros | 2.50 | 2.87 | 3.00 | (3.01) | (3.20) |

An overview of the most important financial data on Acciona.

The company has been swimming on a wave of success since 2012. However, this was preceded by a significant drop in price: Between 2009 and 2012, the share had lost two thirds of its value. As a result, the price at the beginning of 2019 was just under 1.5 percent higher than at the beginning of 2009, although the share gained around 4.4 percent in the past year alone, while the Euro Stoxx 50 and many other European stock indices lost value at the same time , In 2018, sales will probably exceed the value of 7.3 billion euros from the previous year, which in turn was around 1.3 billion euros higher than in 2016. Earnings before interest, taxes, depreciation and amortization (EBITDA) have also increased every year since 2014, even though net profit (and therefore earnings per share) was unusually high in 2016.

background: The origins of the company pass back to the year 1862, to a Galician railway company, which later operated under the abbreviation MZOV. Mention should also be made of the merger with Entrecanales y Tavora, a company that was created when the San Telmo Bridge was built in Seville. At times Acciona was one of the largest shareholders of the Spanish electricity company ENDESA, but has since sold its stake, as well as the business with wind turbines.

Rating:

Gelsenwasser: Number 1 in Germany

There is no heavyweight like Veolia in Germany. This is not only because of the federal structure, but also because in Germany, the municipalities are primarily responsible for the electricity and water supply are. There are hardly any large water suppliers, especially since most of them are in municipal hands.

A The exception is the Gelsenwasser company, one of the largest drinking water suppliers in Germany. Its shares are traded on the Düsseldorf stock exchanges. The size of the activities is not comparable to that of Veolia. Gelsenwasser operates the water network in some municipalities in the Ruhr area and holds shares in many other providers. For example, the company owns 49 percent of Stadtentwässerung Dresden GmbH. A French subsidiary of Gelsenwasser operates, among other things, the drinking water network in the overseas department of Guadeloupe. Gelsenwasser’s turnover of 1.2 billion in 2017 is significantly below that of Veolia and even below that of many municipal utilities.

| 2015 | 2016 | 2017 | 2018 | 2019 (e) | |

|---|---|---|---|---|---|

| Turnover in billion euros | 1.0 | 1.0 | 1.2 | (1.5) | . |

| Earnings per share in euros | 24.53 | 31.75 | 26.85 | (24.40) | . |

| Dividend per share in euros | 21.16 | 21.16 | 21.16 | (21.16) | . |

The most important financial data on Gelsenwasser at a glance.

Unlike large electricity suppliers such as RWE, Gelsenwasser has so far been able to keep sales and profits stable and even increase them slightly. For 2018, sales in the first three quarters were around 300 million higher than in the previous year and annual sales are also likely to significantly exceed those of the previous year.

However, profits fell in parallel. For 2018, Gelsenwasser wants to exceed the profit target of 85 million, but that means a profit decline of up to eight million euros. The company sees the reason for the drop in profits in rising wage costs and the absence of special effects. Significant book profits were made on the sale of equipment in 2017 because the sales price was above the recognized value.

background: Gelsenwasser was founded in 1887 as a water supplier for the northern Ruhr area. In addition to the cities of Bochum and Dortmund, VEBA also held shares in the company, which it contributed to E.ON in 2000. As early as 2003, E.ON sold its stake to the cities of Bochum and Dortmund, which are the most important shareholders today.

rating:

Suez: Make money with waste and water

French Suez S.A. is more suitable for risk-taking investors. The company is highly volatile and has seen significant upward and downward movements in the past ten years. From 2010 to 2012, the price halved, then increased by 150 percent within a little over two years and then fell again by more than 40 percent from 2015 to early 2018. In 2018, the stock grew against the trend, but from November 2018 to early February 2019 again developed significantly worse than the market. Over the next three, five or ten years, investors have lost money with this stock. So anyone who accesses is betting on a turnaround.

It is uncertain that this will happen, but it is by no means unlikely. Because Suez was able to significantly increase its sales in the first three quarters of 2018. After stagnating for a long time, revenue rose 15.8 percent year-on-year in the first three quarters. If one excludes special effects, organic growth of 3.8 percent remains.

| 2015 | 2016 | 2017 | 2018 (e) | 2019 (e) | |

|---|---|---|---|---|---|

| Turnover in billion euros | 15.14 | 15.32 | 15.87 | (17.27) | . |

| Earnings per share in euros | 0.78 | 0.74 | 0.46 | (0.54) | (0.64) |

| Dividend per share in euros | 0.65 | 0.65 | 0.65 | 0.65 | (0.65) |

An overview of the most important financial data on Suez.

Profit should also increase for the first time in years. While sales stagnated, earnings per share fell. However, a higher profit is expected again for 2018. Because the dividend has remained constant at EUR 0.65 per share over the years, the dividend yield is also very attractive.

Suez, for example, is responsible for the water supply in the Saudi Arabian city of Jeddah, which has a population of three million. The special feature: 98 percent of the drinking water is obtained from sea water. So Suez has technology that could prove useful in other growing and coastal cities.

background: The French company is a spin-off from Engie, which in turn results from a merger of Gaz de France with Suez S.A. emerged. Incidentally, the company bears its name because of the involvement of a previous company in the construction of the Suez Canal.

The merger with GdF and the extensive separation afterwards brought the advantage that the company is now completely specialized in the fields of waste and water, which is why it operated under Suez Environnement until 2015 (the spelling with two n after the o corresponds to the French spelling).

rating:

- Suez is more suitable for risk-taking investors.

- If the trend reverses, the company could benefit from its international orientation and experience in the business of drinking water from seawater.

- But: Suez has not made friends with its shareholders in the past ten years.

Open a custody account at Consorsbank now and buy Suez shares

| Top 5 stock brokers | costs Depot p.a.. |

costs per order |

costs total |

|

|---|---|---|---|---|

| 1 | € 0.00 | € 2.08 | € 24.96 | to DEGIRO |

| 2 | € 0.00 | € 5.00 | € 60.00 | to Flatex |

| 3 | € 0.00 | € 6.50 | € 78.00 | to OnVista |

| 4 | € 0.00 | € 10.90 | € 130.80 | to Consorbank |

| 5 | € 0.00 | € 5.80 | € 69.60 | to LYNX |

Invest in water with funds

In the case of equity funds, fund management takes care of the selection of the shares. Spreading across multiple stocks lowers the risk. In particular, water stocks from Africa or water stocks from China are only recommended for professionals as a single investment due to the political risks. Funds are the better solution here. Funds also offer advantages for stocks from industrialized countries, but at the same time the costs are higher. Overall, funds are often the better choice for beginners due to their simpler, more user-friendly structure.

The three best water equity funds

However, equity funds have the disadvantage that the investor has no control over which securities he buys. We have therefore selected a fund with a good rating, a water share ETF and a fund that stands out particularly due to its strict ethical criteria.

The RobecoSAM Sustainable Water Fund B received the top rating A from FERI. The fund invests at least 2/3 of its assets in companies that earn their money related to water. However, due to the high sales charge, it is only suitable if investments are made over several years.

The Robeco website also provides information on the development of the fund.

However, the fund has seen its positive development in recent years – despite the high sales charge. In the first quarter of 2019, the fund was clearly positive both in the short term (for one and three months) and for one, three, five and ten years. Excluding the front-end load, the fund struck the Euro Stoxx 50 over all of the periods mentioned.

The ÖkoWorld Water for Life C funds is also actively managed, but is subject to particularly strict ethical criteria. Nevertheless, the price rose by almost half from 2013 to 2018, whereby profits in the past are of course no guarantee for earnings in the future.

The fund presentation on the side of the investment company Ökoworld.

From mid-2018, however, the fund suffered significant losses. The turnaround did not come until early 2019, although the price is still below the high of 2018.

Against that comes Water UCITS ETF D without sales commission. As the name suggests, it is a water ETF, i.e. an exchange-traded fund. One should speak even more precisely of an exchange-traded index fund, because instead of actively selecting stocks, the World Water CW Net Return is simply replicated.

For five and ten years it was even more successful than all active water funds included in the comparison. It was surpassed by the RobecoSAM water fund for over a year and three, but after taking the sales charge into account it also cuts here Water UCITS ETF D better off.

RELATED ITEMS

-

11 Nice cafés – restaurants on the water, with pleasure Berlin

11 sentences that physiotherapists can no longer hear Oh summer, we want to spend every minute with you! Although Berlin is not necessarily a city on…

-

Experiment water, surface tension, paper clip

If you put a paper clip on water, it goes down – of course. In certain circumstances, however, it can also float on water, such as this one…

-

The Russian government wants to raise income tax

The president has not yet decided whether the income tax should be increased. The Russian government wants two percent in conversation…

-

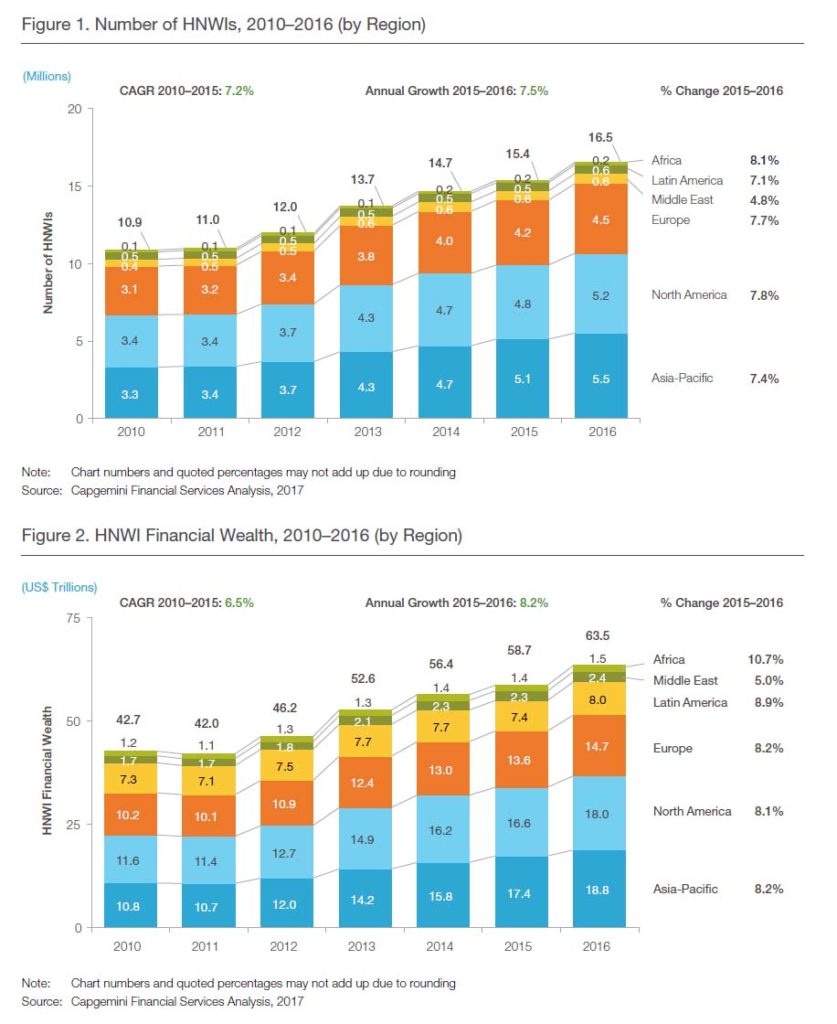

In which country are the most millionaires? Contra magazine

The current economic and financial system favors the accumulation of capital in the hands of a few. Where are most millionaires? Where…