Occupational Disability Insurance Comparison: Find the right fare

Quick Navigation:

Disability insurance test to close the pension gap

The occupational disability insurance, also known colloquially as disability insurance or BU insurance, protects the policyholder from the risk of being unable to work due to illness or accident. Whereas persons who were born before 1 January 1961 receive a disability pension from the state, ie are legally insured against occupational disability, all those born after that have to take care of themselves for occupational disability insurance. Ideally, you will receive a statutory reduced earning capacity, which is just under one third of your last gross salary. What remains is a not insignificant pension gap in case of occupational incapacity, which should necessarily be closed by a private occupational disability insurance.

Disability pension is insufficient

For all persons born after January 1, 1961, no legal disability insurance will be paid. Ideally, you will only receive a disability pension, the around 32% of the last gross salary is. But there is also this legal protection only in full, if the person concerned can work less than three hours a day. It is not about the last profession, but about being able to pursue an activity at all. As a rule, appropriate medical reports are required to prove this condition. If the person is still able to do any kind of work for between 3 and 6 hours a day, they will only receive a proportionate, usually half, disability pension.

However, this is not the only requirement for obtaining the legal payment. Also, the affected person already has paid into the pension fund for at least 5 years to have. In addition, within the last 5 years before the occurrence of the reduction in earning capacity at least 3 years compulsory contributions for an insured activity.

Definition of occupational disability

For the term disability exists under insurers mostly no uniform definition. Predominantly one speaks of occupational disability, if the currently practiced occupation by health reasons, z. As a disease, injury or loss of strength, not more or only less than 50% can exercise. However, this must be the case in the long term. In addition, another prerequisite may exist: in this case, the insured person must also be unable to perform any other activity that he or she might pursue due to their education and skills. However, this other occupational activity should correspond to the previous life position of the person.

However, the above-mentioned variant for the definition of occupational disability does not have to apply to every insurance company. Because depending on Design of the contract conditions It is also possible that the disability is linked to other aspects:

There may be deviations, from which percentage of BU the insured person receives benefits from the insurance. This percentage can be both higher and lower than the commonly used 50%.

Also Season rules are possible within a disability insurance. This means that you have a right to 40% of the agreed insurance benefit for a disability degree of 40%. If so, the report must specify the exact percentage of occupational disability.

There is also the possibility that the expected Duration of disability plays a role. So you would not be incapacitated for work, for example, if you can not work in his job for at least 6 months. Here, however, a larger period can be chosen.

For excluded pre-existing conditions Basically, there is no entitlement to benefits, which is why they also play no role in determining the BU grade.

Especially should on the “Abandoning abstract referral” be respected. If this is the case, it is only a question of assessing occupational disability that concrete employment can no longer be exercised.

In some contracts, the disability can also be extended to a previous one, for 6 months existing, incapacity for work be knotted. If this condition persists after half a year, you are considered unfit for work. Often in such a case retroactively for the past six months is done.

Which of these regulations, as definitions for occupational disability, applies to the various BU tariffs should definitely be checked in advance. For precisely these points make it particularly important in a disability insurance comparison exactly on the respective contract terms to pay attention.

Disability Insurance: Identify important terms >

Although there is no common definition for the word occupational disability, one automatically becomes one with this topic, different terminology faced. Here it is important to keep track and to be able to delineate these sensibly from each other.

Unlike the term disability is the word disability a condition in which the insured person, who due to illness or disability is indefinitely unable to engage in gainful employment or earn an income therefrom.

The health insurance company speaks of incapacity for work , if the insured, e.g. because of a disease, can not pursue his previous employment. Or this is only possible with the danger that his condition worsens.

The term disability on the other hand, is not related to the consequences for current employment. This term is used when it comes to indicating the impairment of the body. Often disability is also used as a generic term for the already defined words.

Occupational disability insurance compared to disability insurance

Often the Disability insurance also as Disability Insurance designated. Although both products deal with the problem that someone can no longer practice his profession, but it is basically two different insurance options.

While the disability insurance usually pays the agreed pension when the current profession can no longer be exercised, you will only receive a benefit from the disability insurance if neither one’s own nor another profession can be exercised. However, as the risk of occupational disability is significantly higher than disability, disability insurance contributions are usually more favorable.

If you are employed as a civil servant and can no longer exercise his activity due to insufficient physical or mental powers, we speak of incapacity. Invalidity is not equal to occupational disability, so that despite invalidity does not receive benefits from the BU insurance. That is precisely why officials should make sure that the disability insurance also includes a disability clause. Even if this is usually only valid until the age of 55.

Yet another variant that may be encountered in the search for insurance to protect the workforce, the Dread Disease Insurance. This can be settled in their scope of benefits still under the disability insurance. It only works if the insured person has a major illness is diagnosed. The specific types of illness that can be affected depends on the particular insurer.

In addition, one should not confuse a disability insurance with a private long-term care insurance. If the insured person becomes a care case, the occupational disability insurance does not cover the costs of care. In the case of occupational disability, it only provides the amount of the occupational disability pension agreed upon conclusion of the contract.

Disability insurance and tax

Anyone who deals with occupational disability insurance sooner or later comes up against the topic of taxes. What do you have to pay attention to? Can the cost of disability insurance be deducted from the tax? Does the occupational disability pension have to be taxed? Which regulations apply to freelancers and self-employed? The guide "Disability insurance and tax" gives answers to the most important questions.

The basic forms of disability insurance

In addition, it should be noted that it different forms or variants of occupational disability insurance. In principle, a distinction is made here between self-employed occupational disability insurance and supplementary occupational disability insurance.

The Occupational disability insurance is usually completed in combination with another insurance, e.g. with a life insurance or private pension insurance. Instead, occupational disability insurance takes over a protective function, so that the contributions of the insurance combined can continue to be paid. Accordingly, a supplementary occupational disability pension can also be agreed. With such a product should be paid attention to whether one can terminate the combined insurance individually or only together.

At a self-employed occupational disability insurance (SBU) an independent insurance contract is concluded. Based on important data such as age, occupation, hobbies, health status and duration, the personal disability risk is determined. From this then the payable insurance contribution is calculated. An SBU is therefore a BU insurance that is not combined with another product but is concluded as a stand-alone contract. Since self-employed occupational disability insurance, such as term life insurance, is purely risk hedging, it is usually cheaper than the supplementary occupational disability insurance.

The functioning of occupational disability insurance

The occupational disability insurance should be completed, especially if the loss of employment due to illness, injury or deterioration of old age too financial problems would lead. Singles are just as affected as families here. Finally, it is about the general question of whether one could do without the previous salary of this person. In addition, by occupational disability insurance in addition to financial losses and social exclusion should be prevented.

In principle, the occupational disability insurance refers to the occupation which the insured person has exercised until his inability to work. At the same time, professional capacity must be reduced by at least 50% in order to speak of occupational disability. If this is proven by a doctor, the insurance pays the predetermined amount after thorough examination monthly rent.

Although the word “permanent” is used in connection with occupational disabilities, it does not automatically mean the rest of life. So can one Occupational disability also temporary consist. In this case, the disability pension is granted only for a limited period.

Comparison disability insurance: Important factors to consider

Whether one is new to the field and cares for the first time for occupational disability insurance or is dissatisfied with the current tariff, therefore cancel his occupational disability insurance and want to change the provider – to find the right rate for disability insurance, worth the look in a disability insurance comparison. Generally, however, one should note that the amount of the insurance contribution also dependent on personal factors is. These include, for example, the following:

Older: An occupational disability insurance can only be taken out until a certain age. Here, the tariffs are usually based on the age of the respective occupational group, with the age limits may differ from provider to provider.

Job: Since the profession plays a major role in life, the occupational disability insurance classifies the different occupational groups in risk classes. The riskier the job, the higher the risk of becoming unfit for work, and the higher the contribution to occupational disability insurance. So it is very important to specify the profession correctly, otherwise you could lose the insurance coverage due to the misstatement.

Gender: When occupational disability insurance was taken out before 2013, the contribution of men and women differed. Since 1 January 2013, only unisex tariffs may be offered where the applicant’s gender is no longer relevant.

Health status: Especially this is crucial. For example, smokers are more vulnerable than nonsmokers to becoming disabled. But other illnesses or injuries can affect the disability insurance costs. Again, it is important to answer the health questions honestly, otherwise there is no performance in case of disability.

Insurance period: This period describes the final age, ie the age that the insured person must have at most in order to receive benefits.

Pension amount: This is the sum that is paid monthly in the event of an insured event. It is also often possible to arrange a waiting period. This means that the insurance does not pay immediately in case of occupational disability, but only after a certain waiting period. This can lower the amount of contributions. However, one should be sure that one can bridge the waiting time with other savings.

Often there is a desire for one Disability insurance without health issues, but these are usually mandatory at the conclusion of such insurance. Finally, the state of health of the policyholder is carefully examined in order to better assess the risk of insuring it. Precisely for this reason, a reputable provider will usually insist on a corresponding health check. Accordingly, it is important that all information is made correctly, otherwise there is a risk that in the event of damage no occupational disability insurance. Those who are not sure whether they even receive a disability insurance because of already existing illnesses can make an anonymous risk inquiry and thus avoid a rejection by an insurer.

Alternatives to the BU

You do not receive a BU or can not afford the protection simply? There are some alternatives that offer similar protection and are often cheaper. For example

Occupational Disability Insurance Comparison: What else is important?

Anyone who is aware of these key points for a disability insurance should pay close attention to other details when comparing different rates. For example, the Forecast period a major role. This contract clause describes how long the occupational disability is likely to last at least in order to receive the pension. Also provisions for Nachversicherungsgarantie as well as the so-called Post dynamics should be checked. A post-insurance guarantee means that the sum insured can be adjusted retrospectively and without re-examination due to special events such as marriage or childbirth. It can often be set instead of or in addition to a contribution dynamization. Dynamization ensures that possible payments are adjusted to expected inflation, which is particularly important for younger policyholders.

For occupational disability insurance, compare surplus usage

As occupational disability insurance is generally a purely risk insurance that only pays off if the insured person actually becomes unable to work. Thus, at the end of the term, there is often no repayment of the contributions already paid. However, insurance companies usually require less money for disability pensions than previously assumed. This results in surpluses, which the insurer in turn creates and which must be passed on in part to the policyholders. So there are different possibilities for a corresponding one Profit sharing:

The surpluses can take the form of a BonusRente be saved. This means that the policyholder continues to pay the normal contribution, but increases his or her pension entitlement if an occupational disability occurs. The disadvantage of this is that of this profit participation is only benefited when it actually comes to occupational disability. In addition, the supplementary pension may decrease again if the surplus has to be used up by the company.

Another form of profit participation is the against premiums. Here, the surpluses are immediately offset against the contributions of the insured, so that the rates paid decline. But here too, the insurance company can increase the contributions again up to the original amount.

The third variant of the profit participation is the refund. Here, the surpluses are saved at interest and paid out to the policyholder at the end of the contract period in one amount. This is also the case if the policyholder actually became unfit for work. Whereby this regulation only applies to the surpluses paid up to this moment.

According to the third variant, some insurers also offer the To invest surplus in a fund, which may yield a higher return than a traditional investment on the capital market. However, it should be noted that this insurer’s fund savings plan is usually tied to the term of the disability insurance and thus can not be terminated easily.

Occupational disability insurance comparison helps to keep track

Since occupational disability is becoming an increasingly important factor in the world of work, everyone should deal with this issue. Especially if only one person in the family receives the income, it is beyond question whether a disability insurance makes sense. Although there are groups that are more vulnerable per se than others, even workers in jobs without much risk should not go to one cheap disability insurance renounce.

However, the label should be used with caution at this point with caution, after all, it is primarily about finding the most appropriate and thus best disability insurance. Whichever Services or additional modules should contain the appropriate tariff. So it is important not to select the first provider, but to perform a disability insurance comparison. Also occupational disability insurance test winners provide a first clue to determine the appropriate tariff.

So it should not just be one Disability insurance price comparison, but also a search of the available services and valid insurance conditions. While it is clear that costs also play a crucial role in decision-making, a comparison of occupational disabilities gives a much broader overview of the details.

Related Posts

-

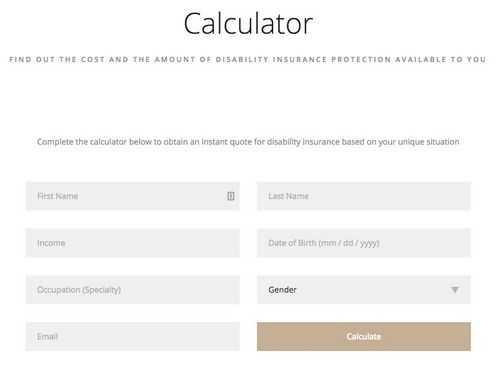

Disability insurance calculator

Disability insurance BU tariffs necessarily compare: Cheap alone is not enough One in four workers does not make it to the retirement pension. Unable to…

-

Death benefit insurance comparison: secure for death

Death benefit insurance comparison: no costs left Summary Monthly contributions are paid into an insurance company, which pays the agreed sum in the…

-

Foreign health insurance comparison: now secure travel protection

International health insurance comparison: optimally protected worldwide Table of Contents: A cold, a broken leg, a serious car accident: On vacation or…

-

Term life insurance compared to the protection of the dearest

Risk life insurance comparison: How to protect your family financially Table of Contents: Financed with the term life insurance in case of emergency The…