Riester pension The higher allowance turns out to be an air number

The state is finally generous: Instead of 154 euros, it will pay savers 175 euros in the future. But most are happy too early. That brings you little. To be precise: nothing.

- Share article by:

- Share article by:

Average pensions

According to the latest figures from the German Pension Insurance, men received an average pension of EUR 1013 at the end of 2014. Women, including survivor’s pension, have to make do with an average of 762 euros per month.

swell: German pension insurance; dbb, as of April 2016

East Berlin with the highest, West Berlin with the lowest pensions

The amount of the pension varies between the federal states. Men in East Berlin can look forward to the highest average pension at € 1147. In West Berlin, on the other hand, it is the lowest at 980 euros.

Male retirees are currently getting:

in Baden-Württemberg an average of 1107 euros per month

in Bavaria an average of 1031 euros per month

in Berlin (West) an average of 980 euros per month

in Berlin (East) an average of 1147 euros per month

in Brandenburg an average of 1078 euros per month

in Bremen an average of 1040 euros per month

in Hamburg an average of 1071 euros per month

in Hesse an average of 1084 euros per month

in Mecklenburg-Western Pomerania an average of 1027 euros per month

in Lower Saxony an average of 1051 euros per month

in North Rhine-Westphalia an average of 1127 euros per month

in Saarland an average of 1115 euros per month

in Saxony-Anhalt an average of 1069 euros per month

in Saxony an average of 1098 euros per month

in Schleswig-Holstein an average of 1061 euros per month

in Thuringia an average of 1064 euros per month

Women with significantly less pensions

Retired women get a good third less than men. They also get the highest pay in East Berlin with an average of 1051 euros. The least they get with 696 euros in Rhineland-Palatinate.

According to German pension insurance, women receive a survivor’s pension including:

in Baden-Württemberg an average of 772 euros per month

in Bavaria an average of 736 euros per month

in Berlin (West) an average of 861 euros per month

in Berlin (East) an average of 1051 euros per month

in Brandenburg an average of 975 euros per month

in Bremen an average of 771 euros per month

in Hamburg an average of 848 euros per month

in Hessen an average of 760 euros per month

in Mecklenburg-Western Pomerania an average of 950 euros per month

in Lower Saxony an average of 727 euros per month

in North Rhine-Westphalia an average of 749 euros per month

in Saarland an average of 699 euros per month

in Saxony-Anhalt an average of 964 euros per month

in Saxony an average of 983 euros per month

in Schleswig-Holstein an average of 744 euros per month

in Thuringia an average of 968 euros per month

Official pensions significantly higher

Civil servants are much better off in old age. In Germany you currently receive an average gross pension of EUR 2730. Compared to 2000, this is an increase of almost 27 percent.

However, the amount of pensions fluctuates between the federal states. While in 2015 a Hessian civil servant received an average of EUR 3,150 in retirement, in Saxony-Anhalt it was only EUR 1,40.

In comparison to federal officials, the state servants are still doing well. On average, they currently have a pension of 2970 euros. In the federal government it is only 2340 euros.

pension increase

Compared to pensions, normal pensions rose significantly less between 2000 and 2014. They only grew by 15.3 percent.

Reserves of the pension fund

The German pension insurance has a rich financial cushion. According to the German Pension Insurance, the so-called sustainability reserve was at the end of 2014 I agree 35 billion euros. That is around three billion euros more than a year earlier. Mathematically, the financial cushion is enough to pay almost two monthly expenses.

Below is an overview of which pension Germans can currently expect on average:

Deviations from the standard pensioner

Anyone who has worked in the old federal states for 45 years and earned the average wage will receive € 1,314 a month.

After 40 years of work, the monthly payment is reduced to 1168 euros. Anyone who was only 35 years in the job gets 1022 euros.

Sales can rub their hands. If the Riester allowance increases from EUR 154 to EUR 175 at the beginning of 2018, the Riester agent has one more selling point. This increase contained in the new company pension strengthening law – the Federal Council passed the law on Friday – should boost the paralyzing sale of Riester: After all, the state is now giving savers even more money, it will be heard. The only problem is: the advertising message is misleading. Most Riester savers do not benefit from the higher allowance at all.

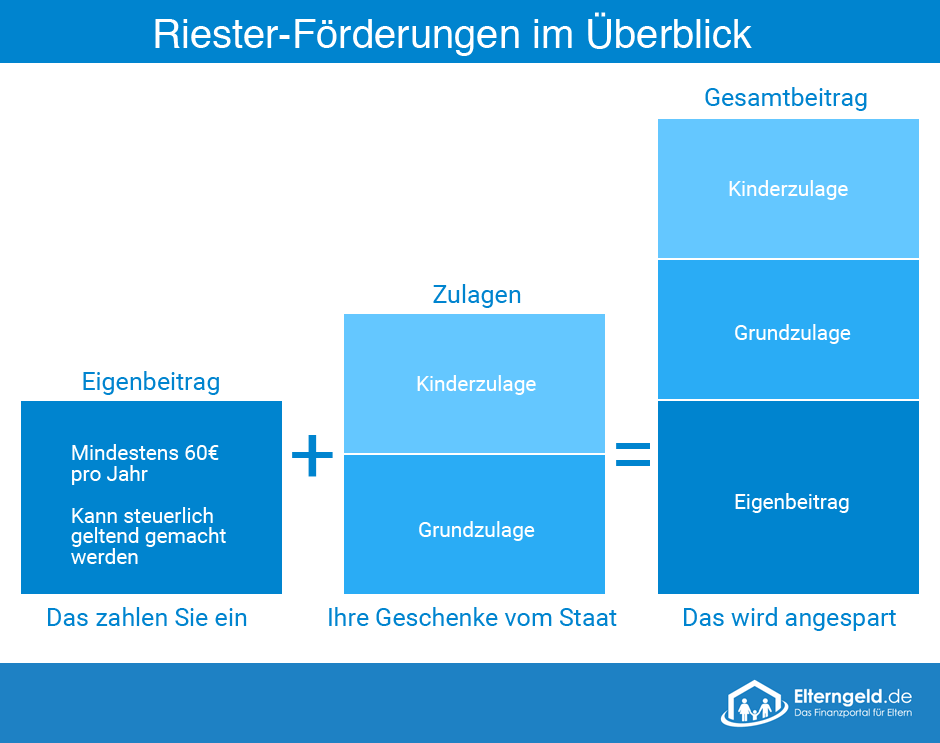

To understand this, you have to understand the basic features of state-sponsored retirement provision à la Riester. All compulsory insured persons in pension insurance are entitled to the subsidy, but also civil servants – to name just the two largest groups of people. If savers from this groups pay at least four percent of their gross previous year’s income into the contract with their own contributions and state allowances (but a maximum of 2100 euros), then they are entitled to full state support.

This state subsidy looks like this: The state grants direct money, previously 154 euros per saver, in the future 175 euros a year. For children, parents are entitled to extra allowances, which only one parent receives. The amount of the child allowance is 300 euros or, if the child was born before 2008, 185 euros. This child allowance continues to flow as long as there is entitlement to child benefit.

Company pension scheme This is what the next generation’s pension looks like

The allowances were a great advertising message for financial sales right from the start. Because a "money gift" from the state – who should refuse that??

In addition to the allowances, there is also tax incentive. The contributions paid into the Riester contract are not subject to income tax, so they can be paid from the gross income. Anyone who states the contributions in their tax return will therefore be reimbursed for the tax paid. But, be careful, not the entire arithmetical tax – i.e. the sum of the contributions multiplied by the personal tax rate – is reimbursed. Instead, the allowances already paid are deducted from the calculated tax benefit. Only if there is a higher tax benefit does the taxpayer really get money back.

What prevents workers from making more private provision

Six percent of those surveyed said that the subject of private provision was underestimated.

Eight percent of those surveyed stated that they preferred consumption to private provision.

Eight percent of those surveyed stated that they were resigned to retirement provision.

Missing time is one of the main problems for nine percent.

Eleven percent of those surveyed lack knowledge or the necessary information about the topic.

A lack of government support is a problem for 21 percent of those surveyed.

Too little income and wealth are a problem for 57 percent of those surveyed.

A numerical example shows the effect: A Riester savers, 45 years old, without children and with taxable income of 52,500 euros per year, paid a total of 2100 euros per year into the contract. The state subsidized a basic allowance of 154 euros. We set the tax rate on every additional income euro (also called marginal tax rate) at 40 percent. The saver also saves so much tax if something is deducted from taxable income. The arithmetical tax savings here are 40 percent of 2100 euros, i.e. 840 euros. But because the saver has already received 154 euros as an allowance, they are deducted. The bottom line is that he only gets back 686 euros through the tax return (840 euros minus 154 euros).

Small plus with children

The allowances are therefore unimportant for most normal to high earners. Each additional euro allowance is one euro less for the tax benefit. It only looks different with several children. If the saver in the example were married and the common income would be just as high as that of the single saver, i.e. 52,500 euros, the couple’s marginal tax rate would drop to around 30 percent. The arithmetical tax advantage then only amounts to 630 euros. If the saver also had two children, the total allowance would be 754 euros – now higher than the tax benefit of just 630 euros. He would therefore not get anything back for his Riester contributions through the tax return, but should keep the allowances. This saver would therefore benefit from the increase in early 2018, instead of € 754 he would then receive € 775 from the state in the future.

Badly informed

The Germans buy cars, computers, kitchen appliances and go on trips. Numerous reviews are often read before buying. However, when it comes to insurance and your own provision, things look different. Sufficient information is important to avoid expensive mistakes.

Source: Institut GenerationenBeratung IGB

Incomplete provision

Individual, important parts of old-age provision are often forgotten. This includes:

1) individual power of attorney

3) Clarification of finances in the case of care

The wrong adviser

“Including friends, family and acquaintances in all pension matters is important and strengthens the bond between them. But relying solely on their advice would be fatal, ”says Margit Winkler from the GenerationsBeratung Institute. Because only trained financial advisors could be held liable. You are obliged to document all insurance and pension products discussed.

Prevention is not always precaution

Everyone should adjust their pension plans to their own needs, general tips from advisors or friends are usually of little use. Depending on the family situation, other insurance and pension benefits may be important. “Especially in patchwork situations or in the case of married spouses, other rules of the game apply in the provision", says Winkler.

Black sheep

Therefore, caution is required when choosing the adviser, there are black sheep on the move in the industry. If a consultant does not respond to the personal situation or particularly praises a certain product, the customers should pay attention.

Informs the conversation

If you want to avoid mistakes in the course of incorrect advice, you have to inform yourself beforehand. The better the customer is informed in the consultation, the sooner he can unmask bad consultants.

Precautionary patchwork

Consultant Winkler warns against concluding too many contracts with many different consultants. In the end, the insured threatened to lose track of what was better, a holistic solution that was tailored to the individual situation.

An increase in allowances therefore primarily benefits low-wage earners (for whom the calculated tax advantage is small due to their low tax rate) and normal earners with more than one child (only then does the sum of the allowances exceed their arithmetical tax advantage). According to data from the Federal Statistical Office in 2013, 42 percent of families in Germany have only one child, another 42 percent have two children and only 15 percent have three or more children. This alone shows that a large proportion of savers will not benefit from the higher allowance.

You then have the tax benefit. But that is also worth a second look. Because if you only look at the deposit phase of the Riester pension, you will be misled. Unfortunately, this is the rule, for example in sales talks, where consultants like to calculate funding rates ("Look, you don’t pay 40 percent of your contributions yourself? Where else can you find that??"). Such consultants provide neither comprehensive nor neutral information. The truth is: the counterpart of state funding in the deposit phase is a big disadvantage of Riester pension when paying out: The Riester pension must be taxed at 100 percent. Of course, this does not mean that the state retains 100 percent of it, but that the personal tax rate applies to the complete payment.

RELATED ITEMS

-

What changes in 2018: these laws came into effect on 1

New laws came into force Cyclists, pensioners, families: It has been different since New Year. At the turn of the year, numerous well-intentioned innovations came into being…

-

Child benefit makes a valuable contribution to the financial relief of parents: the amount of the corresponding allowances and the related…

-

Schwabing-west 2017: this brings the new year in the quarter, schwabing-west

What the new year will bring to the district in 2017 Schwabing-West: Decide >Updated: 02/01/17 10:20 AM Munich – What’s next for the creative district,…

-

Riester pension: only in 2020 will it really make sense!

Advantages and disadvantages at a glance and whether it really pays off for you…