Advantages and disadvantages at a glance and whether it really pays off for you

the essentials in brief

- In principle, anyone who pays into the state pension insurance or pays in his spouse can be a giant.

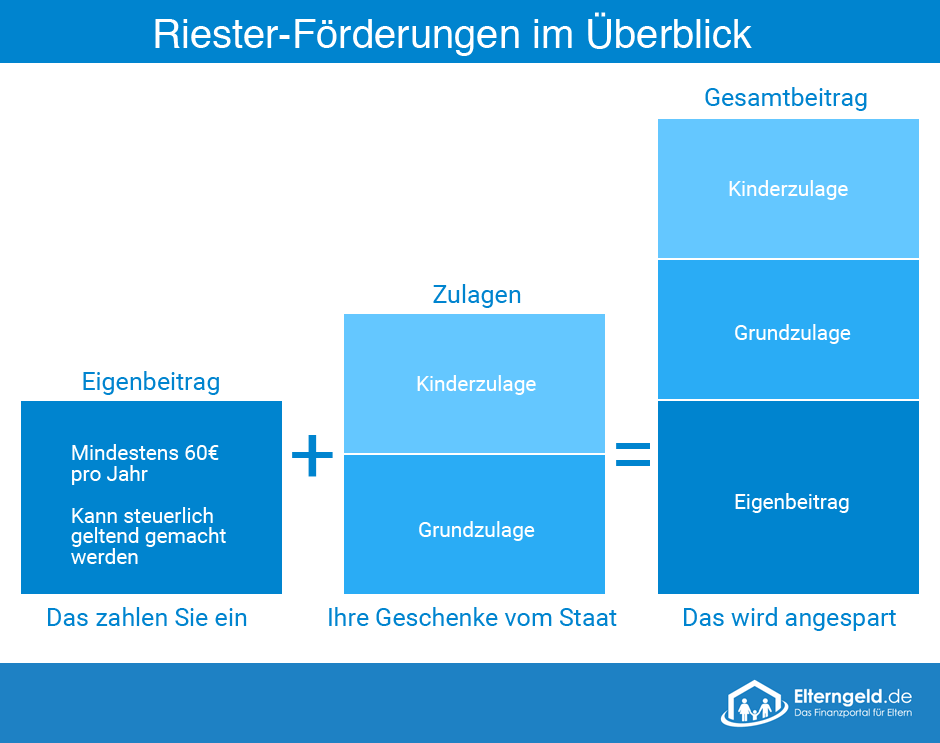

- For the full funding, the contribution is 4% of the gross income subject to social security contributions last year minus the funding.

- There is government funding in the form of allowances or tax benefits.

- Basic allowance: 175 euros per year plus child allowance of 185 euros for children born before January 1, 2008 and 300 euros per year for children born after December 31, 2007.

- New since 2018: The Riester pension is now worthwhile for everyone, since it does not count towards basic security in old age.

Table of Contents

Basics of the Riester pension

As you will see, the Riester pension issue is more complex than some people think. The different investment options for your Riester pension, however, almost all have the same facts during the savings phase and the drawing of the pension. At residential Riester there are one or two deviations.

Who receives state funding for Riester pensions?

In order to receive the state grant for the Riester pension, you must be compulsorily insured in the German statutory pension insurance. This applies to most normal workers. Those receiving unemployment benefit, sickness benefit and unemployment benefit II are also entitled to the Riester subsidy. Self-employed persons who are subject to compulsory insurance, compulsorily insured farmers, and military and civilian service providers are also eligible. Officials, judges and soldiers receive state support if they are not subject to compulsory insurance only because they receive civil-law-related or civil-law-related benefits. Mini-jobbers also benefit from state funding, when they’re not on waive the contribution of the contribution to the pension insurance.

Spouses or life partners of the above-mentioned groups of people also receive funding, even if they were not entitled to do so themselves. For this, however, they have to pay at least 60 euros per calendar year into a Riester contract.

Amount of support and conditions for the Riester pension

State support for the Riester pension can be provided in two different ways:

- The saver receives the allowance.

- The contributions are recognized as special expenses for tax purposes.

you don’t have to worry about which way is more profitable for you. The tax office carries out a so-called cheaper check and checks whether the allowance or the tax benefit is more profitable for you.

We had already stated that the maximum savings contribution was four percent of gross income subject to social security contributions, up to a maximum of 2,100 euros.

First of all, every Riester saver receives basic funding of 175 euros a year, provided that he has exhausted the four percent as a basis for calculation. The basic support increases for parents by the child allowance. This amounts to 185 euros per year for children born before January 1, 2008 and 300 euros per year for children born after December 31, 2007.

In addition, young professionals will receive a one-time bonus of EUR 200 if they have signed their Riester contract before they are 25 years old.

The diagram opposite shows how important it is to fully utilize the 4% limit.

Only a little more than half of the beneficiaries received the full allowance they were actually entitled to in 2013 and 2014! The reason for this is probably the allowance application that has not been adjusted to a changed income. Secure your full allowance through the permanent allowance application and check your contribution in terms of annual income annually.

Funding at a glance:

| Ninja Column 1 | Ninja Column 2 |

|---|---|

| basic allowance | 175 euros a year |

| Child allowance born before 1.1.2008 | 185 euros a year |

| Child allowance born after December 31, 2007 | 300 euros a year |

| One-off allowance for young professionals | 200 euros |

We want to make the gray theory of Riester funding understandable for you using two examples:

Case 1: Hubert Maier, 55,000 euros income, no children, single

To achieve the full allowance, Mr. Maier must pay at least 4% of his previous year’s income into the Riester contract. This sum would have been reached at 2,200 euros. However, they only have to pay a maximum of 2,100 euros to receive the funding. In addition, he may deduct the basic allowance of 175 euros from his contributions. He pays € 1,925 a year or € 160.42 a month into the contract. If his tax advantage for special expenses deduction of the contributions exceeds the basic allowance, the tax deductibility applies.

Case 2: Simone Huber, 22,000 euros income, twins, born 2010, single parent

Ms. Huber also pays 4% of her previous year’s income into the Riester contract. With an income of 22,000 euros, the maximum savings contribution is 880 euros. From this, however, she can still deduct the allowances for herself and her children. From the 880 euros, another 175 euros basic allowance and two 300 euros child allowances go off, so that your actual own contribution is only 105 euros per year or 8.75 euros per month. The state pays 85% of their total contribution through the Allowances for the Riester pension. The tax component does not apply to this arrangement.

May I also pay less into the contract?

You are of course free to pay less than the income-related size into the contract. But remember that this will lead to a reduction in the allowance! Riester pays off, the higher the allowance! You can adjust or pause the posts at any time.

What happens if I want to cancel the Riester contract??

In contrast to a company pension scheme, you can certainly cancel a Riester pension. However, you should calculate well in advance whether it is worth it. In principle, all reimbursed allowances are returned to the state. The same applies to possible tax advantages.

If your Riester contract is insurance, it is in your own interest imperative that you inform yourself beforehand about the surrender value. It is known that commissions flow with an insurance company. These can amount to 30 or 40 per thousand of the calculated contribution amount. The commission is retained from your savings contributions over the first few years and reduces the savings. It would not be the first time that the surrender value of a pension insurance, and this also applies to Riester, is lower than the paid-up credit.

This cost factor does not exist for a bank savings contract and mutual funds. The notice period for a Riester contract is generally three months at the end of the quarter.

Tip: Exemption from contributions as a more sensible alternative

You are better off with a contribution exemption than with the termination of your Riester pension.

- There are no costs.

- Allowances received remain in the contract balance.

- Opportunity to service the contract again at any time.

- Acquired claims remain.

When do I have to pay back the allowances received??

In addition to the termination, there are other situations in which you have to pay back the allowances received.

- The Riester saver dies during the savings phase. Only the spouse can continue the contract without damage to the allowance. In the case of other heirs, the allowance agency reclaims the funding received.

- If capital is withdrawn before the start of the agreed pension payment. The exception is that you use this money to purchase owner-occupied residential property.

- Wohn-Riester provides other reasons for a repayment, which we will cover in more detail in the corresponding section.

- It is important that the Riester pension is not paid worldwide. The pensioner must be within the EU, otherwise this will also damage the allowance.

Can I transfer the credit from Riester contracts??

Those who want to change their investment form for the Riester pension can do so at any time. Here, however, we have to great Place "but" in the room.

On the one hand, the delivering contractual partner has the right to charge you a maximum fee of 150 euros. On the other hand, you may have to bear the final costs again. If you switch from one insurance company to another, for example, the transaction costs described above arise again. Of course, these significantly reduce the return on the contract.

The legislature does provide for a company to release an existing contract. However, there is no requirement for acceptance by another company. Here the financial greed of the respective financial service providers was probably used.

You are on the safe side if you clarify in advance with a planned change with your new partner that they accept the contract.

What principles must Riester products fulfill in order for state funding to be paid??

So that your Riester savings contract also comes under state funding, it must be certified by BaFin. Certification assumes that the contract meets the following requirements:

- The contract guaranteed a guaranteed amount of pension, at least paid contributions plus allowances. This also applies to investment savings contracts.

- The pension payment begins at the earliest from the age of 62 (for contracts with a closing date before January 1, 2013, the age of 60 still applies).

- The Riester pension guarantees lifelong pension payments. You may not use more than 30% of the saved capital as a one-time payment.

- The contract allows breaks in contributions.

- A product change must be possible.

- Acquisition and distribution costs must be spread over at least five years.

- The product provider provides the customer with comprehensive information about various details such as the use of contributions, investment aspects and the closing, sales and administration costs.

- The pension benefit must at least remain the same, or increase.

- 20% of the contribution may be used to include survivor’s pension or to cover an occupational or incapacity for work.

- There are only two exceptions to these basics. If the statutory pension insurance provides for an earlier retirement age than 62 for certain occupational groups, this limit applies accordingly. This regulation applies to pilots and miners, for example.

- Additional criteria apply to residential Riester contracts, which we will explain in the special section on residential Riester contracts.

What types of Riester contracts are there??

You can build up your personal Riester pension through various forms of savings. Each may have its individual advantages and disadvantages, and the investor’s willingness to take risks also plays a role in the selection, as does life planning.

The following ways are available:

- Pension insurance (classic or unit-linked)

- Savings plans (unit-linked or classic)

- Direct insurance, pension fund, pension fund within the company pension scheme – Attention! (Why "Attention!", We explain in the corresponding section.)

- Housing Riester loans

- Housing Riester-savings contracts

While savings plans are only offered by very few banks, you can take out all other products through any bank, broker or sales representative of a financial service provider.

So far you have informed yourself about the basics of the Riester pension. In the following we would like to introduce the individual savings variants with all their advantages and disadvantages and work out who is worth which variant.

Now we are through with the basics of the Riester pension. At this point, we can tell you one thing: Riester is worth it despite all the criticism – provided you choose the variant that is best compatible with your life planning. We want to help you with that.

RELATED ITEMS

-

What happens to Riester pension after divorce, easily explained

Riester pension problems do not always arise when a couple divorces. There are no problems if … … a childless one…

-

Inheritance tax – how much tax is really payable?

By: Redaktion December 11, 2018 Everyone who inherits more than the tax-free allowance must pay inheritance tax. It can be…

-

How computer games make people happy

Adults often talk about computer games being bad for children. You must have noticed that before. But is it really like that?…

-

What defines a safe child seat, safetymum

Juhu! Go on vacation by car! Or just in the next supermarket. For toddlers, driving in the car is still a real one at first…