The tax calculator can be used to calculate the amount of wage tax and other tax deductions from the gross monthly salary. Calculate quickly and easy Your tax levies with our tax calculator.

F i r m e n w a g e n R e c h n e r

Tax calculator with gross net calculation

The tax calculator provides a quick overview of the various taxes to be paid. What is such an overview of taxes good for? The tax calculator clearly lists how high, for example, the wage tax is in a month. Taxes are automatically deducted from the gross wages each month. The tax calculator calculates income tax, church tax and the solidarity surcharge – all taxes can be calculated using the tax calculator. If you have an overview of the income tax, you also know how much could be paid back, for example, with a tax return. The income tax can be refunded via the tax return. The tax calculator helps to get an overview of the taxes to be paid per month and per year.

Rate this article

| Table of Contents: |

|---|

|

|

|

|

|

|

|

|

|

|

|

|

The advantages of the tax calculator at a glance

| The tax calculator is free. With the tax calculator you can easily calculate the net salary. The tax calculator helps to find out whether the tax class should be changed. With the tax calculator you can save taxes under certain circumstances. |

What information is required for the control computer?

| Information for the control computer | explanation |

|---|---|

| gross wage | An employee’s gross wages represent the total agreed wages paid by the employer before the tax is deducted. |

| gross wage | An employee’s gross wages represent the total agreed wages paid by the employer before the tax is deducted. |

| Age | With age, the current age is indicated in the tax calculator. |

| children | If children are to be taken into account, a child allowance is entered in the income tax card for each child and transferred to the tax calculator for calculation. Depending on the assessment requirement, this can be a complete or half tax-free allowance. |

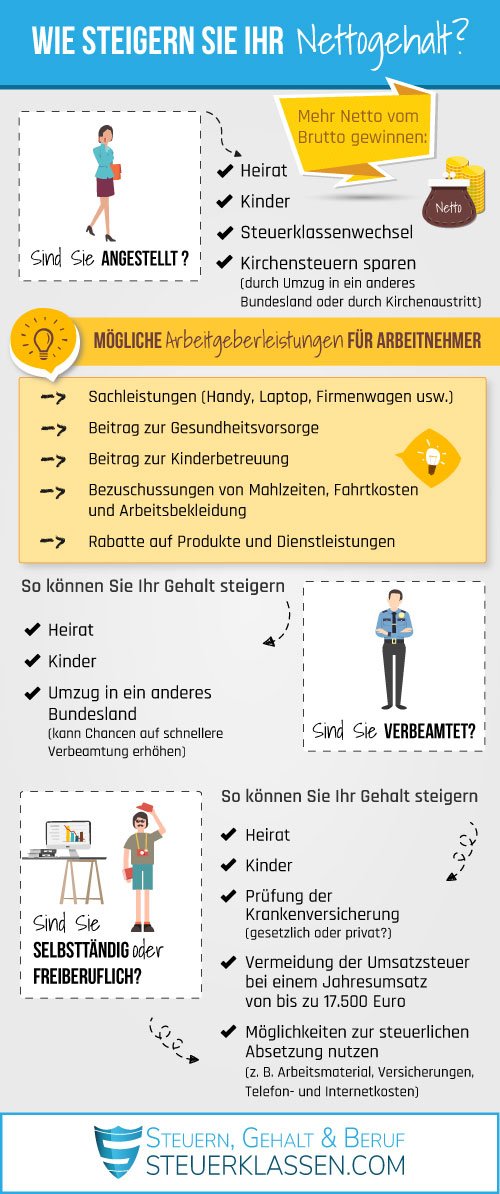

| tax bracket | The number of euros to be paid for the wage tax due depends on the wage level and the tax class entered. Depending on the family circumstances, these income tax groups can be changed and lead to different results in the calculation. |

| Tax credit | The tax-free allowance is a basic tax-free allowance that does not include taxes. That is the share of income that does not have to be taxed and that is deducted in advance. |

| church tax | Nobody is subject to church tax and whoever is not in a legally recognized religious community does not have to pay the corresponding taxes. The tax is calculated on the basis of income or wage tax, which is an important item in the tax calculator. |

| state | Specifying the correct state is also important in the tax calculator for calculation, because the church tax rate is not the same in every state. |

| Health insurance | In Germany, a distinction is made between statutory and private health insurance. The monthly contribution rate of private health insurance can deviate significantly from the standard rates of statutory health insurance and has a significant influence on the calculation. |

| PKV contribution rate | The PKV contribution rate describes the monthly health insurance contribution to be paid for private health insurance. In contrast to the statutory contribution rate, it is an indication in euros and not in percent. |

| contribution rate | With regard to the contribution rate of the statutory health insurance protection, a distinction is made between the regular contribution (14.6% plus additional contribution from the respective statutory health insurance, 2020 average 0.9%) and the reduced contribution rate (14.0%). This applies, for example, to voluntarily health insured persons, who then have no claim to sickness benefit. |

| Statutory pension insurance | For the statutory pension insurance come different contribution assessment limits to bear. These differ in the old and new federal states: in 2020, the assessment limits for statutory pension insurance will be in the west, e.g. at 82,800 euros annually, in the east, however, at 77,400 euros. |

| accounting year | Income tax is recalculated every year. In contrast to non-natural persons (companies, corporations, cooperatives, etc.), the accounting year does not deviate from the calendar year. Therefore, the calculation in the tax calculator is always based on calendar years. |

Taxes briefly explained

income tax

Taxes are payable on all incomes of natural persons in Germany. This affects domestic residents as well as those who live abroad and generate income in Germany.

Income tax law distinguishes between:

- income

- agreements

- revenue

- and taxable income.

The taxable income is the calculation basis for the collective income tax amount.

These taxes are referred to as withholding taxes because they are paid directly from the source of the capital.

The tax collections are to be understood as advance payments: the tax advance payments that have already been made can then be adjusted in the subsequent tax return.

Capital gains tax

The capital gains tax is a method of collecting income tax. The tax is levied on different capital gains, including why

- Interest and dividends

- certificate trading

- Share transactions

- as well as income from appropriately defined insurance contracts

The capital gains tax is a linear tax, which means that the tax rate does not change in relation to the amount of income. This withholding tax is paid directly by the companies, banks and insurers from which investment income is generated.

income tax

The income tax is the most extensive income tax. In 2017, wages tax revenue amounted to around 196 million euros, similar figures are also to be expected according to the upcoming evaluation at the beginning of 2020.

All non-self-employed work is taxed via income tax. So this affects workers and employees alike.

- The tax rate can be influenced by the choice of income tax classes. In addition, strictly speaking, no income tax return is submitted if the taxpayer receives further investment income: an income tax return is then carried out and the income tax is part of these taxes.

church tax

Church tax is not a tax that counts as income tax. However, income and wage tax represent the calculation for this.

For this reason, we also speak of a church income tax or church wage tax. The entire church tax is made up of one of these two taxes and the church property tax.

It should also be noted that this tax is assessed differently depending on the federal state and that no one is generally liable for church tax.

The most important facts about the tax calculator

- The tax calculator facilitates the calculation of taxes through various selection options.

- Not all forms of income tax are important for the tax calculator.

- The net salary can be calculated using the tax calculator.

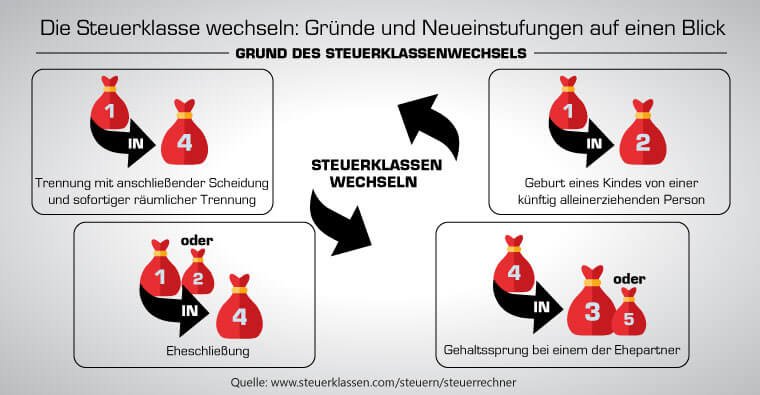

- You can also calculate whether a tax class change would be worthwhile, e.g. B. after marriage.

- In addition, the tax calculator illustrates which levy is particularly important.

Tax calculator: Frequently asked questions

How does the child allowance affect the net salary?

With the examination of the income tax return, the tax office carries out a more favorable examination. The child allowance can make itself felt here.

The child allowance therefore has no effect on the net salary. On the contrary: if a child benefit was previously applied for and it turns out that the child tax exemption is more worthwhile for the taxpayer than the child benefit, there is even money back.

How does church tax affect net salary?

In general, church tax is not a tax that is deducted from your salary per se. Rather, there is a duty to pay taxes only if you have a corresponding religious affiliation. In addition to the income tax, the church tax leads to a reduction in the net salary, as this is withheld directly. However, the situation in the individual federal states varies with regard to the amount of church tax. Except in Baden-Württemberg and Bavaria (eight percent), the church tax rate is nine percent.

Individual evidence and sources

- Federal Ministry of Justice and Consumer Protection: Income Tax Act→

- Federal Ministry for Family, Women, Seniors and Youth: Child allowances→

- Federal Ministry of Finance: Tax relief for employees, families and single parents→

- Federal Ministry of Finance: Leaflet on tax class selection→

Overwhelmed with your taxes?

We will find a solution to your problem!

Find your dream job with StepStone!

Start now for free

Disclaimer: Despite careful examination, we assume no liability for the completeness, accuracy or timeliness of the information presented here. No services are reserved that are reserved for professionals according to the StBerG and RBerG.

RELATED ITEMS

-

Your everyday life revolves around children. Therefore, you are not only creative and happy, but have nerves of steel. Bring you out of calm so quickly…

-

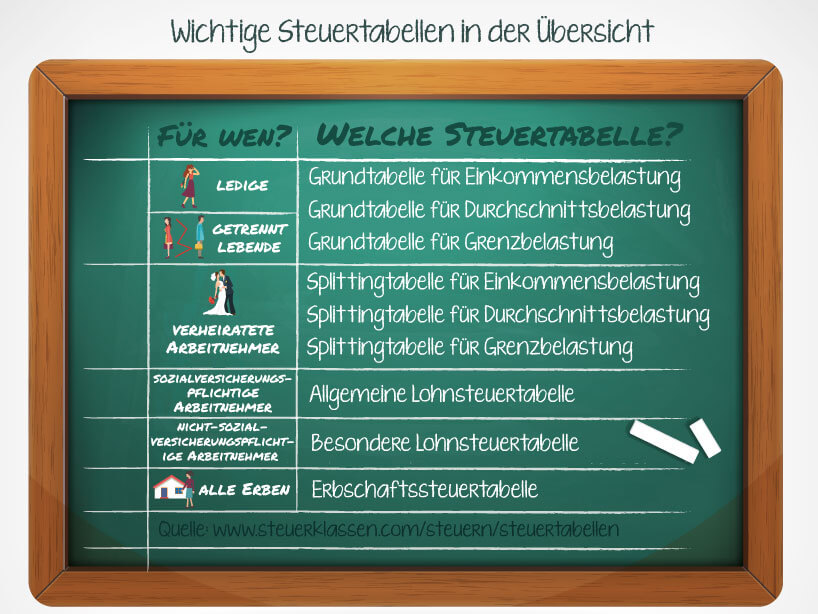

Control tables – all important data at a glance

The income tax tables have been created to quickly calculate the income tax payable. To pay the…

-

Under certain conditions, there is the possibility that parents can apply for a child supplement in addition to child benefit. One has…

-

Child allowance or child benefit – which is better

The first statement of this article is as follows: whether the child benefit or child allowance is used for a taxable person…