Disability insurance

Why is occupational disability insurance useful??

The occupational disability insurance makes an important contribution to the protection of personal

Living and social circumstances dar.

From the professional capacity of a worker usually not only depends

its own wealth. Common are family members and other relatives

provided with additional pension, social and liability liabilities, which also

persist in the event of occupational disability.

Of the Elimination of the ability to practice the learned or factually practiced profession

moreover leads to sensitive cuts in its own economic and social position.

In addition to the usually associated with incapacity for work convalescence or permanent health restrictions for a professional re-entry or the maintenance of financial income is often not a possibility. The occupational disability insurance compensates for such cuts and takes over the agreed supply either in part (in the case of reduced occupational ability or inability to work) or in full up to the agreed regular benefits.

Occupational disability insurance vs. Disability Insurance

In some pension plans or individual pension plans, a basic disability is insured. Disadvantage of the disability insurance in comparison to the disability insurance is that the benefits relate to the ability to work as a whole. Occupational breakdowns could therefore mean that, although the ability to pursue one’s own profession no longer exists – in principle (usually inferior) employment can still be taken over. The invalidity insurance examines here only the theoretical conditions regardless of actual circumstances in the labor market. Their benefits do not apply accordingly, if there is a professional capacity, but no incapacity.

Occupational disability insurance, on the other hand, focuses specifically on the conditions necessary for the pursuit of a specific profession. If these disappear completely or partially, the insured event occurs. The insured person is therefore not dependent on the acceptance of each profession to safeguard his living conditions. The occupational disability insurance insures on defined conditions of certain insured job profiles.

What benefits, dangers and damages are insured in a disability insurance?

The occupational disability insurance is considered under insurance law as a so-called sum insurance. The opposite is the non-life insurance. This means: The occupational disability insurance replaces an agreed upon benefit value from the time the damage occurred. Thus, it can not intervene for property or property damage actually occurring in connection with the occupational disability. In this context, it also does not advocate compensation for liability claims.

As a total or sum insurance, the occupational disability insurance occurs when the insured person’s exercise of his profession has become completely or partially impossible. The main reason for the occurrence of the insured event is medical background. As a rule, the circumstance of occupational disability refers to the physical and mental impairment of the insured person with direct reference to the conditions for the exercise of a particular occupation. The reasons are given by a medical statement or medical report.

- Partial elimination of professional capacity

The insured benefits and risks in occupational disability insurance vary depending on the job description. For example, having a chronic pelvic disorder has different meanings when it comes to assessing the impact on professional performance of work in construction compared to office or home activities. The determination of the impairment is made by a medical certificate, which, depending on the circumstances, can be accompanied by a medical report. In addition, the specific terms of insurance govern the classification of the impairment.

Depending on the assessment of the occupational impairment and the resulting actual reduction of the occupational activity, the occupational disability insurance makes a compensation contribution, which is intended to compensate for the difference between the actual earnings reduction. Exact agreements regulate the respective individual insurance regulations.

Note: Particularly important are special inclusions for special occupational groups, e.g. medical professions or occupations with particularly high qualification requirements. - Complete failure of professional performance

In the event of total loss of the ability to practice the profession, the occupational disability insurance shall pay the policyholder a fixed monthly amount, as agreed in the insurance contract. This amount can be adjusted regularly before the occurrence of the insured event, depending on the regulations of the insurer. In addition, performance increases adapted to the respective service volume may be included, which compensate for inflation compensation after the occurrence of the insured event. The exact determination is made in the insurance contract. For example, If a waiver of the abstract referral tool (stating that the job related to the previous job could still be exercised) is waived and the claim is considered entirely occupational.

What should be considered when taking out occupational disability insurance??

Before the conclusion of the disability insurance

Even before the conclusion of occupational disability insurance, certain regulations must be taken into account. For the service agreements u.a.

- vocational training

- Occupation at work

- Further education and its effect on the actual merit

- Actually performed activity

- Etc.

decisive for the minimum benefit of occupational disability insurance required in the insured event

to ensure.

In the conditions for the determination of the respective insurance options and above all

the conditions for the occurrence of the claim also include previous illnesses, chronic illnesses

or other permanent health problems. Medical reports in conjunction with the insurance conditions provide clarity as to when and in what amount the occupational disability insurance will occur. The more precisely these performance provisions are observed in advance, the more valuable is the scope of benefits for occupational disability insurance.

Adaptation of occupational disability insurance to the specific occupation

In addition to the basic provisions, it is important for optimal disability insurance how the services are designed for specific job descriptions. Thus, e.g. medical professions special provisions on infectious diseases that are not inherent in other professions.

In addition to the professional description of the profession exercised and in addition to the original name of the training occupation, it is also important which factual activity the policyholder exercises and the associated risks.

Certain special uses in the course of a career often lead to an expansion of activity and thus to an increased severity of eventual disability.

In order to precisely adjust the occupational disability insurance for all cases, a detailed examination of the insurance circumstances is recommended in advance. In a comparison In addition to the insurance rates, the disability insurance should therefore also and above all be subject to a comparison of the insurance providers‘ performance and coverage, in the event of insurance coverage to largely rule out any gaps in coverage. Further topics around the disability insurance.

What costs are covered by a disability insurance in the event of a claim??

As compensation insurance, occupational disability insurance compensates for financial losses resulting from reduced or impossible practice. The basis for the benefits is the current earnings of the policyholder, on the basis of which a fixed maximum remuneration is paid each month. The income can be determined according to factuality, pay tables or self-employed after tax statements, etc..

Power expenditure of occupational disability insurance in the event of loss

The exact and consistent presetting of occupational disability insurance is of particular importance in the event of a claim. In contrast to non-life insurance, the occupational disability insurance provides fixed amounts in advance to the policyholder. The effect is thus comparable to a pension payment – decidedly extended to benefits that are not included in the general pension rights. The determination of the benefit in the event of a claim is based on

- Belonging to a specific professional group

- Amount of installments and agreed payments in case of loss

- work experience

- if applicable, other provisions that have been specified in the respective insurance contract.

The occupational disability insurance with partial occupational disability

The agreed amount of benefits does not have to be exhausted for the insured event to occur. Already a partial impairment of the ability to practice the profession leads to the fact that the disability insurance provides. This benefit, after a certain commitment, replaces part of the loss of earnings resulting from a reduced job.

The occupational disability insurance for occupational disability

The disability insurance is designed in the event that the professional capacity of the policyholder completely eliminated. The benefit is then usually paid in monthly installments to the policyholder for a predetermined amount. Depending on the insurer, the amount may be adjusted to include annual performance increases, for example, within the expected inflationary trend.

Cost of medical reports

If medical reports are required by the insurance company, they usually bear the costs of these reports. This also applies to any tests of continuing disability after a certain period of time.

What costs are not covered by the disability insurance?

In their capacity as Total insurance realizes the occupational disability insurance predetermined benefits to the policyholder. Upon determination of the insured event, these benefits occur.

The amount is (taking into account any annual adjustments) fixed and independent of further damage, the u. U. conditioned.

These include, if necessary:

- financial losses

- Liability claims

- Benefits for rehabilitation or other healing and restoration costs

- social or medical assistance and care services

- Aids for disease management

- recovery costs

- Etc.

This definition of performance is particularly important in the light of the fact that in the majority of cases occupational disability is associated with further medical costs for which other insurance or pension models have to pay. Accordingly, such benefits are excluded from occupational disability insurance, the costs of which are not focused on the reduction of occupational activity.

Special feature: financial loss

Against certain backgrounds, the loss of professional ability is associated with a financial loss. In certain cases, the financial loss resulting from a job restriction can not be determined solely from the current remuneration, but for the future Increase in income, career change or special expertise for disproportionate income increase in weight.

Depending on the circumstances, in addition to occupational disability insurance, certain financial loss insurance policies can be used to provide further benefits. Likewise, additional health and provident insurances can provide benefits that compensate for the benefits of occupational disability insurance. The disability insurance itself, however, does not directly affect the pecuniary loss.

Pension payments in the sense of the earned pension / old-age pension

The occupational disability insurance replaces exclusively quantifiable income payments which can be determined on the basis of previous activity on the basis of a concrete agreement. It pays no pension benefits in the sense of a retirement pension.

How do I behave when it comes to disability insurance??

The loss event occurs in the occupational disability insurance if a doctor determines the partial or complete impairment of the ability to work. This impairment can be due to illness, accidents, injury or deterioration. In addition, special medical reports can be requested from the Disability Insurance to clarify the scope and specific benefit obligations. The declaration of occupational disability insurance is made by the policyholder to the occupational disability insurance, i.V. by medical assistance. This message is the responsibility of the policyholder.

Pension benefits in occupational disability insurance

Regular health check-ups are prescribed for certain occupational groups, compliance with which may have to be proven in relation to occupational disability insurance. Depending on the insurance contract, these check-ups influence the insurance benefits.

In addition, preventive examinations are also suitable for detecting a deterioration in professional performance in good time.

After determining the occupational disability, all documentation must be handed over to the occupational disability insurance in full. When choosing and supplementing the insurer supports accordingly. As a result, an assessment of occupational disability arises. According to general case law, the insured event starts with a disability starting from 6 months. It must be forecast for 3 years. A repeat examination may be required by the insurance company.

When does the insurance cover begin??

The occupational disability insurance begins immediately upon completion. For this reason, before concluding the insurance contract, all important criteria regarding the terms of insurance are clarified.

As a rule, there are no waiting periods for occupational disability insurance in general or

in principle. Depending on the contract

and, above all, the risk assessment of certain occupational groups, certain reasons for occupational impairment may be waived.

For the most part, reasons for mental limitations are given against this background. However, the more precise conditions are regulated by the individual insurance contract. Also for the calculation of the insurance rate can set individually or according to occupational groups staggered waiting periods until the first possible occurrence of an insured event.

The insured event triggers the payment obligation immediately. However, the occupational disability insurance must only take place if the loss of work or the restriction lasts longer than 6 months. The payment is then made from this point in time retroactively from the date of the damage on the month.

On the basis of general legal provisions, the commencement of the contract in the occupational disability insurance can be agreed at a later date than the conclusion of the contract. This option can play a role in the form of rates or changes in employment or employment.

Beginning of insurance from payment of the first installments

On the economic side, the contractual conditions for occupational disability insurance usually determine the commencement of the insurance benefit and thus the commencement of the contract at the earliest upon receipt of the first installment by the insurer.

Which coverage amount or sum insured makes sense?

No general cumulative amount is assumed for the calculation of the coverage amount in the occupational disability insurance. The coverage is quantified according to the expected monthly benefits of the occupational disability insurance in the event of an insured event. In order to justify the coverage amount, it becomes important which income structure is the basis for the insurance. This is basically composed

- Real income

- Expected income development

- Nachversicherungsleistungen

- Special regulations for civil servants.

Real income

On the basis of the existing income, part of the necessary coverage is determined. It is important to note which professional experience and which occupational expectations are available at the time of the insurance. Collective agreements or securitized income developments also play a role here.

Expected income development

In addition to already established increases in income, general forecasts either on the basis of developments in the labor market or collective bargaining developments are effective in finding the right amount insured. This income development can already be included in dynamic insurance adjustments when the contract is concluded. The individual insurance contract also regulates the details here.

Nachversicherungsleistungen

In certain circumstances, at the time of the occurrence of the loss, there may be a material disproportion between the lost income and the cover provided by the disability insurance. In the insurance contract, the possibility of subsequent insurance benefits may be agreed for these circumstances, which subsequently adjust insurance benefits in the event of late registration. Possibly. However, this also affects the installment payments. Here, the individual case must be checked.

Disability insurance for civil servants

Civil servants and certain professions in the civil service are subject to collective agreements by the federal states or the federal government to determine the amount of cover. This also includes the income forecast.

What depends on the contribution and what factors influence the contribution rate?

Various factors influence the contribution rate of disability insurance. We show you a selection here. Other factors can be complementary through individual agreements.

- Effect of the insurance age on the contribution amount

The occupational disability insurance pays benefits from disability to a maximum of the statutory retirement age. If it is agreed to limit the benefit period to a lower age, this may influence the insurance rate. - Duration of the insurance contract

(In a direct sense) Regardless of the age of the insured, the insurance period itself can be limited. Limiting the duration of the insurance actually means a reduction of the insurance period upwards. Thus, for example, the expected last working years can be excluded from the insurance benefits and the insurance cover can already be limited by contract to reach the age of 60 years. This clause affects the insurance contribution. - Age at insurance entrance and fixed waiting periods

The age of the policyholder at the conclusion of the occupational disability insurance also plays a role in determining the rate. Comparative calculators automatically take this fact into account when evaluating the optimal insurance solutions. In addition, waiting periods may be agreed which determine the period in which the cause of an insured event exists, for which the occupational disability insurance does not have to pay by contract. The occupational disability insurance then comes into force after this grace period. - Occupational group and agreed insurance benefits

On the basis of the insured occupational group, a criterion for the calculation of the monthly contribution rate is also formed. Naturally, the occupational group itself can not be determined by the policyholder. However, special precautionary and risk reduction measures can have a positive effect. - Furthermore, the desired Insurance benefits agreed individually in the event of a claim become. The principle applies here: the lower the insurance benefit, the more favorable the effect on the insurance rate.

- Defining certain exclusions / inclusions

Belonging to certain occupational groups may require additional agreements, which must be enshrined in the insurance contract accordingly. On the other hand, occupational insurance may form the basis for selectively excluding benefits from occupational disability insurance. Comprehensive advice should form the basis of this, as the agreed exclusion of benefits in particular risks the risk of coverage gaps.

What are the benefits of comparing occupational disability insurance??

The range in disability insurance

is very far. In particular, the possibility of being able to compare subject-specific insurers depending on the occupational group usually makes the individual research effort quickly confusing.

By way of compensation, various comparison portals have specialized in the parallel and comparative listing of occupational disability insurance policies with different performance characteristics,

the basic comparison parameters follow

and to provide a precise and expert overview of insurance benefits and the corresponding cost factors.

Direct comparability of a large number of insurers, also sustainable

A major advantage of the online comparison results from the fact that the compared offers are created on the basis of a comprehensive data. The database includes all major major insurers in addition to the relevant market segments and specialist insurers. The comparison not only takes into account the amount of installments to determine the best offer. The sophistication of the requirements for different job descriptions equally requires a differentiation of the offers according to performance features, such as

- insurance period

- Contract performance maturities

- additional content insurance, benefits inclusion and exclusions

- Occupational group

- Etc.

In addition, the online comparison offers the opportunity to receive regular information on new features and discounted conditions simply and clearly by e-mail.

Possibility of immediate financial statements

Following the successful identification of the corresponding offer, the occupational disability insurance can be booked directly, either directly or with subsequent use of the comparison portal. Additional costs for this service do not arise. However, the benefit of direct brokerage and the allocation of the determined rate can be used directly to directly conclude the optimal disability insurance.

Free telephone consultation by expert consultants

In addition to the online comparison, the online comparison offers a free telephone consultation. All questions that may have remained open after the online comparison or to individual circumstances can be clarified directly here. If the result is satisfactory, the disability insurance can be completed directly by phone according to the online offer. The usual legal provisions for online and telephone contracts apply accordingly.

Can the contributions to the occupational disability insurance be deducted from the tax?

Contributions to occupational disability insurance

can in principle be deducted from the tax.

In general, the assessment is based on the assessment of the special expenditure deduction, which includes the expenditure item other insurance

and e.g. for occupational disability insurance. However, the tax implications of the cost of disability insurance are subject to a number of key points.

Tax deduction in the employment relationship

The tax assessment of other insurance expenditures (expenses for insurance benefits that are not covered by compulsory insurance and are not used to explicitly defend existential losses) is not possible to an unlimited extent. For employees, there are specially limited rates for minimum and maximum expenses up to which a deduction can be made. The occupational disability insurance is calculated here in connection with health and long-term care benefits (KV, PV). For a positive tax significance, the total expenditures count here. From a certain annual income, the additional costs for occupational disability insurance no longer fall within the scope of taxation due to the percentage adjusted incomes and PV benefits. An exact examination also against the background of the marital status of the insured is recommended.

Tax deduction for self-employment

The same conditions as in the employment relationship apply in principle also for independent employment. However, the amounts that have to be paid for the PP and PV vary considerably. Possibly. Other pension benefits are already tax deductible. Here, the respective installment heights should be compared against each other and assessed the most favorable. Again, a consultation is recommended.

What should be considered when terminating the disability insurance??

Termination of existing occupational disability insurance without follow-up insurance or alternative solution is only recommended under certain circumstances. For example, when the necessity of occupational disability insurance is no longer present due to various circumstances.

- Active termination of an existing contract

Termination of the disability insurance will cancel all benefits after the last effective date. A retroactive effect of the insurance entrance does not take place. Against this background, a fundamental consideration should be given to how the previous investment in occupational disability insurance is valued. Depending on the specific circumstances, new contracts after termination are confronted with additional burdens due to increased entry age and, if necessary, additional charges. The fullest possible examination should take into account, in addition to the absolute level of the rate, the respective effects on the rate. - Contractually agreed shorter insurance term

In addition to the direct termination of an active contract, a premature termination of the disability insurance can be contractually agreed. The premature termination of benefits usually has the meaning of having a positive influence on the installment or premium amount for the disability insurance. This calculated insurance gap can be closed by an experienced exam, if necessary by a favorable connection contract. A special notice does not require the contract in this case.

What should be considered when changing the occupational disability insurance??

Change to the benefit of the rate

The cheapest rate must be substantially below

the previous conditions are estimated,

so that the cost advantage is not only apparent and

made ineffective through extended contributions to the basic premium. The online comparison essentially helps to find the optimum rate in a clearly arranged and prepared according to personal weightings.

Advantage: Modifying factors can be automatically included in the calculation of the rate.

Additional illnesses and increased entry age – increased rate must be compensated

In some cases, the increased burdens caused by the change include additional illnesses that the policyholder did not have to disclose when the existing occupational disability insurance was taken out. In addition, his entry age is naturally higher at a later new conclusion.

When re-selecting occupational disability insurance, a peer-reviewed comparison helps reduce those effects on the rate.

Related Posts

-

Incapacity insurance »insurance check24

Disability Insurance Why is disability insurance useful?? The disability insurance company provides the minimum hedge against the loss the general…

-

Pensioner health insurance, what to pay attention to

retiree health insurance information 1. Benefits of private health insurance The services correspond to the chosen tariffs. The benefits once acquired…

-

Occupational disability insurance comparison: test and tips 2019

Occupational Disability Insurance Comparison: Find the right fare Quick Navigation: Disability insurance test to close the pension gap The occupational…

-

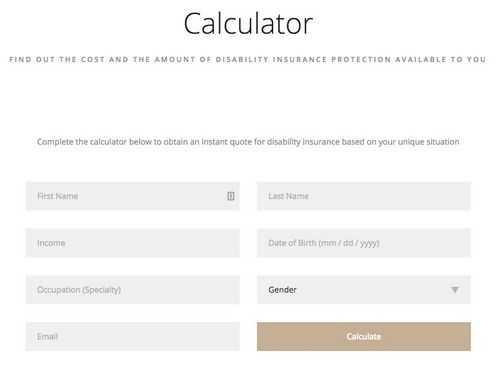

Disability insurance calculator

Disability insurance BU tariffs necessarily compare: Cheap alone is not enough One in four workers does not make it to the retirement pension. Unable to…